Danielle KayeEnterprise reporter

Reuters

ReutersChip large Nvidia beat Wall Avenue’s expectations for income and upcoming gross sales, easing investor issues about heavy synthetic intelligence (AI) spending which have unsettled markets.

In its quarterly earnings report on Wednesday, the agency stated income for the three months to October jumped 62% to $57bn, pushed by demand for its chips utilized in AI knowledge centres. Gross sales from that division rose 66% to greater than $51bn.

Fourth-quarter gross sales forecasts within the vary of $65bn additionally topped estimates, sending shares in Nvidia about 4% increased in after-hours buying and selling.

Nvidia, the world’s most precious firm, is seen as a bellwether for the AI growth. The chip-maker’s outcomes may inform market sentiment.

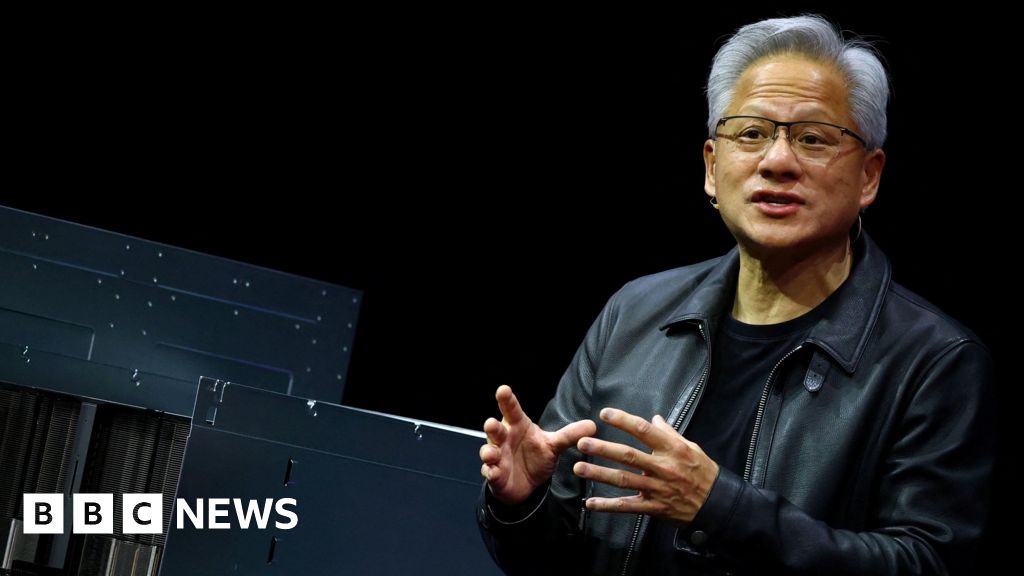

Chief govt Jensen Huang stated in an announcement that gross sales of its AI Blackwell methods have been “off the charts” and that “cloud GPUs [graphics processing units] are bought out”.

“There’s been a number of speak about an AI bubble. From our vantage level, we see one thing very totally different,” he stated, on a name with analysts.

“We excel at each section of AI.”

The chip-maker’s quarterly report garnered much more consideration than traditional on Wall Avenue amid mounting concern that AI shares are overvalued – fears that will persist regardless of Nvidia’s blockbuster outcomes.

These fears had fueled 4 consecutive each day drops within the S&P 500 index main as much as Wednesday, as questions swirl about returns on AI investments. The benchmark index has fallen almost 3% to this point in November.

The bar was excessive heading into Nvidia’s outcomes.

Adam Turnquist, chief technical strategist for LPL Monetary, stated the query was not whether or not the corporate would beat expectations, “however by how a lot”.

“Whereas AI valuations are dominating the information feeds, Nvidia goes about its enterprise in fashion,” stated Matt Britzman, senior fairness analyst at Hargreaves Lansdown.

He stated valuations for sure areas of the AI sector “wanted to take a breather, however Nvidia isn’t in that camp”.

Mr Huang had beforehand stated he anticipated $500bn in AI chip orders by way of subsequent yr. Traders have been in search of particulars about when the corporate expects these revenues will come to fruition, and the way it plans to satisfy the orders.

Colette Kress, Nvidia’s chief monetary officer, instructed analysts the corporate would “most likely” be taking extra orders on prime of the $500bn that had already been introduced.

However she additionally expressed disappointment about regulatory limits that stymie the corporate’s potential to export its chips to China, saying the US “should win the help of each developer” together with these in China.

She stated Nvidia was “dedicated to continued engagement” with the American and Chinese language governments.

EPA/Shutterstock

EPA/ShutterstockThe titans of the know-how sector are ramping up their spending on AI, as they rush to reap the advantages of a growth that has pushed shares to document highs.

Earnings stories from Meta, Alphabet and Microsoft final month reaffirmed the colossal amounts of money these companies are shelling out for every part from knowledge centres to chips.

Sundar Pichai, the pinnacle of Google’s mother or father agency Alphabet, told the BBC that whereas the expansion of AI funding had been an “extraordinary second”, there was some “irrationality” within the present AI growth. His feedback got here amid different warnings from trade leaders.

Nvidia, which makes chips which can be essential for AI knowledge centres, is on the coronary heart of an internet of offers amongst key gamers within the AI house akin to OpenAI, Anthropic and xAI.

The offers have drawn scrutiny for his or her round nature, as AI companies more and more spend money on each other. The agreements embody Nvidia’s $100bn investment in OpenAI, the agency behind ChatGPT.