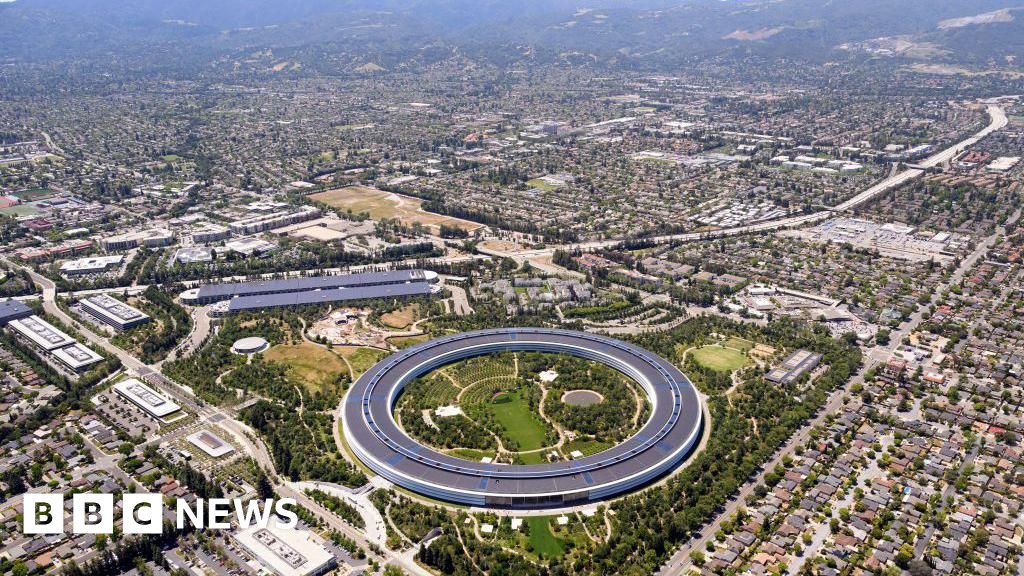

Lily JamaliExpertise correspondent, San Francisco

Getty Photographs

Getty PhotographsAt OpenAI’s DevDay this week, OpenAI boss Sam Altman did what American tech bosses hardly ever do today: he really answered questions from reporters.

“I do know it is tempting to put in writing the bubble story,” Mr Altman advised me as he sat flanked by his prime lieutenants. “In truth, there are various components of AI that I believe are sort of bubbly proper now.”

In Silicon Valley, the talk over whether or not AI corporations are overvalued has taken on a brand new urgency.

Sceptics are privately – and a few now publicly – asking whether or not the fast rise within the worth of AI tech corporations could also be, at the very least partially, the results of what they name “monetary engineering”.

In different phrases – there are fears these corporations are overvalued.

Mr Altman mentioned he anticipated buyers would make some dangerous calls and foolish start-ups would stroll away with loopy cash.

However with OpenAI, he advised me, “there’s one thing actual taking place right here”.

Not everyone seems to be satisfied.

In latest days, warnings of an AI bubble have come from the Financial institution of England, the Worldwide Financial Fund, in addition to JP Morgan boss Jamie Dimon who told the BBC “the extent of uncertainty ought to be increased in most individuals’s minds”.

And right here, in what is commonly thought-about the tech capital of the world, considerations are rising.

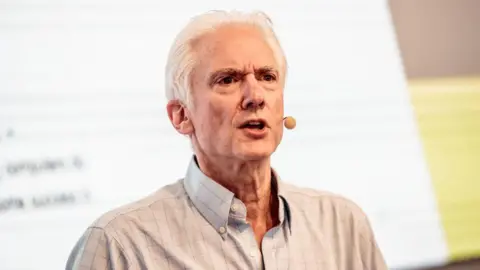

At a panel dialogue at Silicon Valley’s Pc Historical past Museum this week, early AI entrepreneur Jerry Kaplan advised a packed viewers he has lived by way of 4 bubbles.

Getty Photographs

Getty PhotographsHe is particularly involved now given the magnitude of cash on the desk as in comparison with the dot-com increase. There’s a lot extra to lose.

“When [the bubble] breaks, it should be actually dangerous, and never only for individuals in AI,” he mentioned.

“It may drag down the remainder of the economic system.”

Nevertheless, on the Stanford Graduate Faculty of Enterprise, which has minted its justifiable share of tech entrepreneurs, Prof Anat Admati says whereas there have been many makes an attempt to mannequin once we’re within the bubble, it may be a futile train.

“It is rather arduous to time a bubble,” Prof Admati advised me. “And you’ll’t say with certainty you had been in a single till after the bubble has burst.”

However the knowledge is regarding to many.

AI-related enterprises have accounted for 80% of the beautiful good points within the American inventory market this 12 months – and Gartner estimates global spending on AI will doubtless attain a whopping $1.5tn (£1.1tn) earlier than 2025 is out.

Tangled internet of offers

OpenAI, which introduced AI into the buyer mainstream with ChatGPT in 2022, is on the centre of the tangled internet of offers drawing scrutiny.

For instance – final month, it entered right into a $100bn cope with chipmaker Nvidia, which is itself essentially the most invaluable publicly traded firm on this planet.

It expands an present funding Nvidia already had in Mr Altman’s firm – with expectations that OpenAI will construct knowledge centres powered with Nvidia’s superior chips.

Then on Monday, OpenAI introduced plans to buy billions of {dollars} price of kit for growing AI from Nvidia rival AMD, in a deal that might make it one in every of AMD’s largest shareholders.

Bear in mind this can be a non-public firm, albeit one recently valued at a half-trillion dollars.

Then there’s tech big Microsoft, which is closely invested, and cloud computing behemoth Oracle has a $300bn cope with OpenAI, too.

OpenAI’s Stargate project in Abilene, Texas, funded with the assistance of Oracle and Japanese conglomerate SoftBank and introduced on the White Home throughout President Donald Trump’s first week in workplace, grows ever bigger each few months.

And as for Nvidia, it has a stake in AI startup CoreWeave – which provides OpenAI with a few of its huge infrastructure wants.

Getty Photographs

Getty PhotographsAnd as these more and more complicated financing preparations get increasingly more frequent, the consultants right here in Silicon Valley say they might be clouding perceptions on AI demand.

Some individuals aren’t mincing their phrases about it both, calling the offers “round financing” and even “vendor financing” – the place an organization invests in or lends to its personal clients to allow them to proceed making purchases.

“Sure, the funding loans are unprecedented,” Mr Altman advised me on Monday.

However, he added, “it is also unprecedented for corporations to be rising income this quick.”

OpenAI’s income is rising shortly, but it surely has by no means turned a revenue.

And it’s hardly a great signal that the individuals I’ve spoken to maintain mentioning Nortel – the Canadian telecom equipment-maker that borrowed prolifically to assist finance offers for his or her clients (and thereby artificially increase demand for his or her wares).

For his half, Nvidia’s Jensen Huang defended his cope with OpenAI on CNBC Monday, saying the agency is not required to purchase his firm’s tech with the cash he invests.

“They’ll use it to do something they like,” Huang mentioned.

“There is not any exclusivities. Our main objective is simply actually to help them and assist them develop – and develop the ecosystem.”

Telltale indicators

Mr Kaplan says he sees a few telltale indicators the AI sector – and subsequently the broader economic system – might be in hassle.

In frothy occasions, he says, corporations announce main initiatives and product plans that they do not but have the capital for.

In the meantime, retail buyers clamour to get in on the start-up motion.

The surge in AMD inventory this week might point out buyers are attempting to get a bit of the ChatGPT wealth machine – and whereas all that is enjoying out, actual bodily infrastructure aimed toward satisfying the seemingly insatiable starvation for extra AI growth is being constructed.

“We’re creating a brand new man-made ecological catastrophe: huge knowledge centres in distant locations like deserts, that might be rusting away and leaching dangerous issues into the surroundings, with nobody left to carry accountable as a result of the builders and buyers might be lengthy gone,” Mr Kaplan mentioned.

Getty Photographs

Getty PhotographsHowever even when we’re in a bubble, the hope from Silicon Valley is investments being made now will not essentially go to waste.

“The factor that comforts me is that the web was constructed on the ashes of the over-investment into the telecom infrastructure of yesterday,” mentioned Jeff Boudier, who builds merchandise on the AI neighborhood hub Hugging Face.

“If there’s overinvestment into infrastructure for AI workloads, there could also be monetary dangers tied to it,” he mentioned.

“However it should allow a number of nice new merchandise and experiences together with ones we’re not serious about in the present day.”

There are many believers in AI’s potential to remodel society.

The query is whether or not the cash to fund the ambitions of the foremost corporations within the sector could also be drying up.

“Nvidia appears to be like just like the final lender or investor,” mentioned Rihard Jarc, who based the UncoverAlpha e-newsletter.

“Who else has the capability proper now to take a position $100 billion in one other firm?”