Keep knowledgeable with free updates

Merely signal as much as the US inflation myFT Digest — delivered on to your inbox.

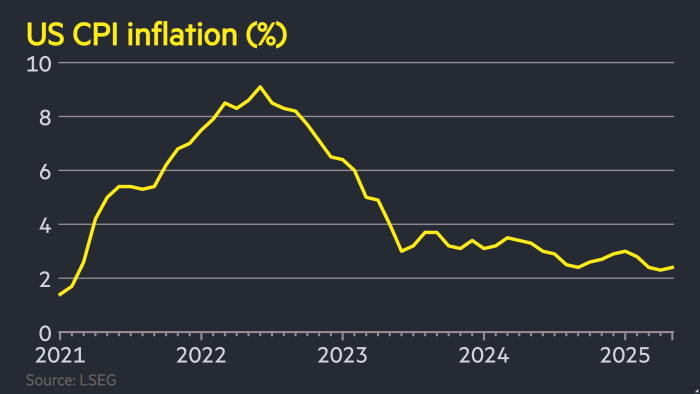

US inflation rose lower than anticipated to 2.4 per cent in Might, signalling Donald Trump’s tariffs are up to now placing solely modest strain on client costs.

Wednesday’s annual client value index determine was beneath the two.5 per cent predicted by analysts surveyed by Bloomberg, however above the two.3 per cent recorded in April.

The core measure, which strips out modifications in meals and power costs, remained flat at 2.8 per cent, towards expectations of a slight rise.

“The increase to client costs from the tariffs stays microscopic for now, although that’s completely consistent with previous proof exhibiting that retailers normally take a minimum of three months to go on price will increase to shoppers,” stated Samuel Tombs, chief US economist at Pantheon Macroeconomics.

Nonetheless, Daniel Hornung, senior fellow at MIT and a deputy director of the Nationwide Financial Council beneath former US president Joe Biden, famous that “it’s an encouraging report, however whenever you dig in a bit bit a variety of what was encouraging about it was in classes, corresponding to airfares, that are actually not associated to tariffs”.

In testimony earlier than the Home methods and means committee on Wednesday, Treasury secretary Scott Bessent stated: “After 4 years of value will increase diminishing the US lifestyle, inflation is exhibiting substantial enchancment as a result of administration’s insurance policies.”

Inflation is anticipated to extend additional within the coming months because the affect of Trump’s tariffs, which had been unveiled in April, is handed on to shoppers and companies on the planet’s largest economic system.

The US at present applies a ten per cent payment to most imports, in addition to a lot increased levies on items from China.

The US two-year Treasury yield, which usually strikes with expectations for financial coverage, dropped virtually 0.1 proportion level following the report back to beneath 3.95 per cent. Wall Avenue shares gave up a optimistic begin to the session, with the S&P 500 dropping steam by means of the day to shut 0.3 per cent decrease. The greenback index was down 0.4 per cent.

The US Federal Reserve is anticipated to carry borrowing costs at between 4.25 per cent and 4.5 per cent when it meets subsequent week, in anticipation of additional rises in inflation. Markets are pricing in two Fed fee cuts by the tip of the yr, with the primary arriving in September or October.

“If inflation stays beneath management or the job market weakens, the Federal Reserve will probably think about reducing rates of interest down the highway,” stated Alexandra Wilson-Elizondo, international co-chief funding officer of Multi-Asset Options at Goldman Sachs Asset Administration. “We count on the Fed to stay on maintain at subsequent week’s assembly, however we see a path to a fee minimize later within the yr.”

Trump has heaped pressure on Fed chair Jay Powell to observe the lead of the European Central Financial institution and the Financial institution of England and minimize borrowing prices this yr, pushing for a full proportion level minimize and calling Powell “a catastrophe”.

US vice-president JD Vance stated in an X submit on Wednesday following the inflation information that the Fed’s “refusal” to chop rates of interest “is financial malpractice”.

Eswar Prasad, professor at Cornell College, stated he anticipated the “comparatively benign” determine to set off extra calls from the White Home for cuts, with financial and political pressures set to change into “more and more troublesome to steadiness within the months forward”.

The Fed’s most well-liked inflation measure, the non-public consumption expenditures index, fell to 2.1 per cent in April, however can also be anticipated to rise within the months forward.