Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

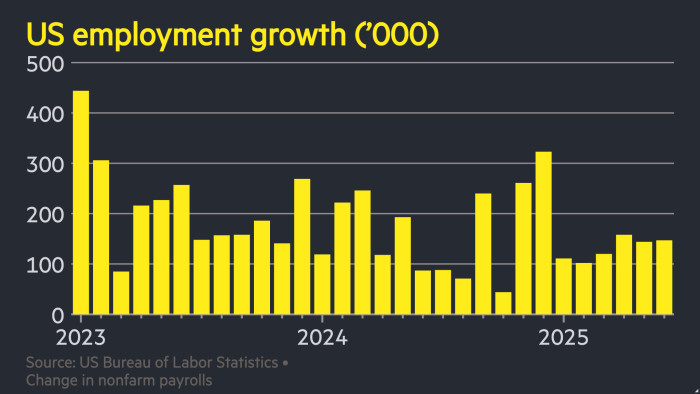

The US economic system added 147,000 jobs in June, defying expectations that commerce uncertainty would trigger hiring to chill and main buyers to cut back their bets on rate of interest cuts.

Thursday’s determine from the Bureau of Labor Statistics surpassed each the upwardly revised 144,000 posts added in Might and the 110,000 predicted by economists polled by Bloomberg, regardless of considerations that Donald Trump’s tariff and immigration insurance policies would soften labour demand.

Wall Road buyers welcomed the information, with the S&P 500 up 0.9 per cent at a file excessive at noon and US authorities bonds promoting off.

The unemployment charge additionally beat expectations, falling barely to 4.1 per cent. Jobs figures for April and Might have been revised increased by a mixed 16,000.

Trump hailed the report, reposting a Division of Labor message on X claiming the BLS figures had “shattered” expectations.

The unexpectedly robust figures ought to ease strain on the US Federal Reserve to chop rates of interest, regardless of the US president’s repeated requires the central financial institution to take action.

Merchants at the moment are betting that there’s a roughly 5 per cent probability of the Fed reducing borrowing prices this month, in contrast with about 25 per cent earlier than the roles information.

“The numbers have been a lot, a lot increased than anticipated,” NatAlliance Securities head of worldwide fastened revenue Andy Brenner stated of the roles information.

“This takes a July reduce off the desk,” Brenner continued. “Even with a large deceleration in [the consumer price index], you’ll not see a reduce from the Fed in July. Even September now could be considerably in query.”

The 2-year US Treasury yield, which strikes with rate of interest expectations and inversely to costs, was up 0.08 proportion factors at noon to three.87 per cent. The greenback gained 0.3 per cent in opposition to a basket of rival currencies as buyers guess the Fed will decrease charges extra slowly than beforehand thought.

The US central financial institution has been cut up over when to chop charges. Its financial coverage “doves” search to decrease borrowing prices to offset any softening of financial development, whereas “hawks” want to carry off owing to fears that tariffs will push up inflation.

Fed chair Jay Powell has confronted continued strain from Trump to chop charges. On Wednesday the president known as on him to “resign instantly”.

Under Thursday’s headline payroll figures, analysts sounded a extra cautious word over the shortage of turnover within the job market and warned the affect of the president’s sweeping tariffs and immigration crackdown would most likely be felt later within the yr.

“The labour market is precariously balanced between modest development and a doubtlessly bigger rise within the unemployment charge within the coming months,” stated Omair Sharif at Inflation Insights.

The small drop within the June unemployment charge was primarily a results of employees leaving the labour market somewhat than discovering work. The variety of individuals in long-term unemployment, or out of labor for 27 weeks or extra, rose by 190,000 to 1.6mn.

“The family survey actually reveals a labour market that has little or no churn,” stated Diane Swonk at KPMG. “There’s a way of a frozen jobs market and we’re not by the ice. The unemployment charge fell, but it surely fell for the mistaken causes.”

The rise within the headline employment determine got here largely from a rise in healthcare jobs and an sudden soar in these employed by US state governments after minimal development over the previous two years.

Three sectors — hospitality and leisure, healthcare, and authorities — accounted for 87 per cent of latest jobs over the previous two-and-a-half years, in response to ING economist James Knightley. “The normal sectors we might sometimes affiliate with a robust and vibrant economic system aren’t including jobs,” he stated.

Federal authorities employment continued to say no within the wake of the cost-cutting drive led by Elon Musk, with jobs now down by 69,000 since January.

Florian Ielpo, head of macro at Lombard Odier Funding Managers, stated the “bump” in state authorities employment “explains a good portion of the rise above the consensus quantity”.

“So globally, not a nasty report, however most likely not as robust as initially steered from the primary learn,” he stated.

Extra reporting by Tommy Stubbington in London