Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

UK rates of interest are on a “gradual downward path” — however doubtlessly not for for much longer.

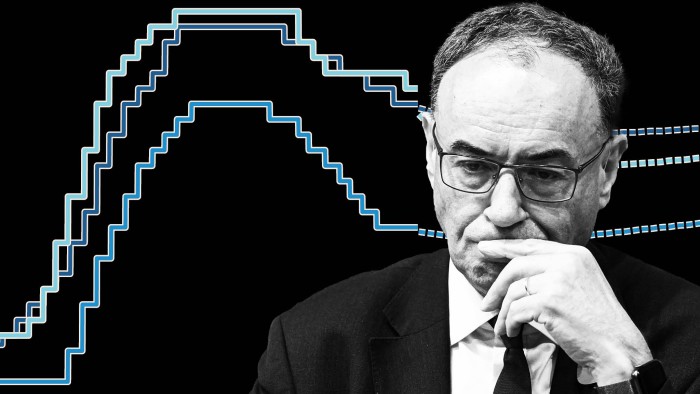

That was the important thing message Bank of England governor Andrew Bailey gave on Thursday as he introduced a new-look set of economic forecasts, providing extra readability than the central financial institution has given on rate-setters’ view of the longer term path of coverage.

For the primary time, members of the Financial Coverage Committee set out the rationale underpinning their particular person votes after deciding by a 5 to 4 majority to go away the BoE’s benchmark rate on hold at 4 per cent.

Bailey wrote present market pricing — implying two additional price cuts to go away the Financial institution price at 3.5 per cent in three years’ time — was “a good description of my place at current”. He added market pricing gave “an affordable view of a wise path”.

His feedback strengthened expectations that the BoE will decrease rates of interest as soon as it may well assess the impression of tax choices taken within the Price range on November 26 and may see an extended run of knowledge to verify inflation is lastly easing.

However the remarks additionally counsel rates of interest could degree out at the next price within the UK than in both the US or the Eurozone.

Allan Monks, chief UK economist at JPMorgan, mentioned: “It does really feel like they’re converging in the direction of a view on a terminal rate of interest that’s larger than I can bear in mind BoE policymakers arguing previously.”

He added: “Some have beforehand pointed in the direction of a impartial price of two per cent or 3 per cent, however the dialog appears to be shifting in the direction of the three to 4 per cent vary. That could be a huge shift that’s related for the coverage outlook.”

With the MPC cut up into two camps — one centered on the dangers of excessive inflation expectations and chronic wage pressures, the opposite on rising unemployment and weak client spending — Bailey emerged because the swing voter, signalling he would favour a reduce if inflation continued to ease.

“I need to see extra proof,” the BoE governor mentioned after the choice, however added the “two huge dangers” troubling the committee had “change into extra balanced” for the reason that summer season.

Paul Dales, chief UK economist on the consultancy Capital Economics, mentioned this prompt Thursday’s vote was “a pause within the downward pattern in rates of interest reasonably than the top”.

However the BoE had additionally signalled it could want “convincing proof” to chop charges additional than 3.5 per cent, he added.

The European Central Financial institution’s benchmark price is about at 2 per cent. Within the US, the median forecast amongst Federal Reserve policymakers for his or her key rate of interest over the long term is 3 per cent.

Some analysts consider the BoE will ultimately reduce rates of interest additional than Bailey signalled.

Andrew Goodwin of Oxford Economics mentioned he believed the MPC would in the end decrease charges to someplace between 2.5 per cent and three per cent. “There’s a truthful option to go but,” he mentioned. However he mentioned given the stickiness of inflation and uncertainty concerning the financial outlook we may see extended durations of pausing in between price strikes, he predicted.

Bailey insisted he had no pre-determined view on the place rates of interest would settle, arguing that makes an attempt to calculate the so-called impartial price — the place coverage is neither stimulating nor constraining the economic system — are too unsure to be of sensible use when setting coverage.

At current, the MPC nonetheless believed coverage was restrictive, he added, however it could must make a brand new judgment on this every time it met — and a few have been extra keen than others to take a view on the place the impartial price lay.

Clare Lombardelli and Dave Ramsden, two of the BoE’s deputy administrators, gave the same message, saying the committee was more and more grappling with the query of the place the “impartial” or “terminal” price would possibly lie.

“There’s a distinction of views,” Lombardelli mentioned. “Figuring out how restrictive you might be . . . is kind of difficult. It will get more difficult as you decrease charges.”

Ramsden mentioned: “We’d all agree we’re getting nearer to the impartial price, or the terminal price . . . The controversy and the best way we’re fascinated with that is inevitably going to evolve and alter in future.”