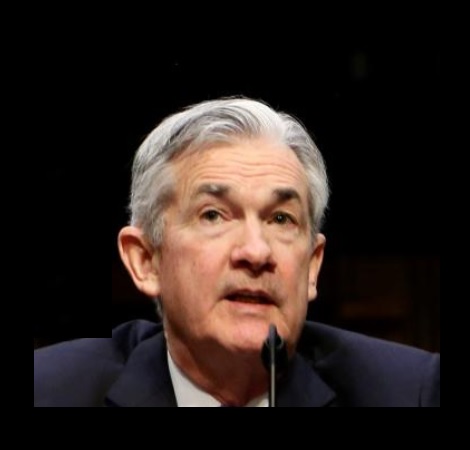

Fed Chair Jerome Powell mentioned he expects inflation to be “transitory,” a phrase harking back to America’s state of affairs three years in the past when the Fed repeatedly urged the general public to underplay inflation as it will enhance. Situations didn’t enhance, as we later realized, and the Fed could have a tough time convincing the markets that this time is completely different.

“It may be the case that it’s acceptable generally to look by means of inflation, if it’s going to go away shortly, with out motion by us, if it’s transitory,” Powell mentioned. “That may be the case within the case of tariff inflation. I feel that might rely upon the tariff inflation shifting by means of pretty shortly and, critically, as nicely on inflation expectations being nicely anchored.”

Shopper spending is essential to the US financial system. Retail spending in February elevated 0.2% after declining 1.2% in January, in accordance with the Division of Commerce, however fell beneath predictions for a 0.6% month-to-month enhance. Whole gross sales from December 2024 to February 2025 rose 3.7% from the identical interval one yr in the past, however development stays minimal.

Individuals don’t spend when confidence is low. The College of Michigan’s shopper sentiment survey indicated a ten% decline in shopper sentiment this March in comparison with February, citing a “excessive stage of uncertainty.”

The Nationwide Federation of Retailers said that February gross sales had slowed as a direct results of tariff threats. “Shopper spending dipped barely once more in February as a result of mixture of harsh winter climate and declining shopper confidence pushed by tariffs, considerations about rising unemployment and coverage uncertainty,” NRF President and CEO Matthew Shay mentioned. “Unease concerning the chance of inflation and paying greater costs for non-discretionary items has the value-conscious shopper spending much less and saving extra. However for the second, year-over-year positive factors replicate an financial system with sturdy fundamentals.”

Retail is America’s largest employer within the public sector, including $5.3 trillion to annual GDP. One in 4 Individuals, 55 million folks, are employed by means of this important sector.

Naturally, the price of dwelling is inflicting a lot upheaval as folks spend extra on much less and save what they’ll. It will be ignorant to say that tariff disputes do not need a direct destructive affect on the financial system. Powell probably coined a brand new time period, “tariff inflation,” which I anticipate we’ll hear extra incessantly.