Faisal IslamEconomics editor

BBC

BBCGoogle’s ultra-private CEO Sundar Pichai is exhibiting me round Googleplex, its California headquarters. A walkway runs alongside the size of it, passing by a large dinosaur skeleton, a seashore volleyball pitch and dozens of Googlers lunching underneath the hazy November solar.

But it surely’s a laboratory, hidden away in the back of the campus behind some timber, that he’s most excited for me to see.

That is the place the invention that Google believes is its secret weapon is being developed.

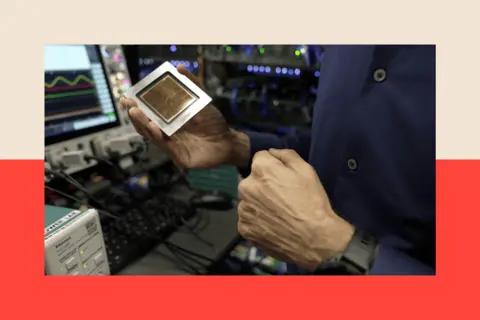

Often called a Tensor Processing Unit (or TPU), it seems like an unassuming little chip however, says Mr Pichai, it is going to in the future energy each AI question that goes by way of Google. This makes it doubtlessly one of the vital essential objects on this planet economic system proper now.

“AI is probably the most profound know-how humanity [has ever worked] on,” he insists. “It has potential for extraordinary advantages – we must work by way of societal disruptions.”

However the complicated query lingering over the AI hype is whether or not it’s a bubble prone to bursting – as, in that case, it could be a spectacular burst akin to the dotcom crash firstly of the century, with penalties for us all.

Bloomberg by way of Getty Pictures

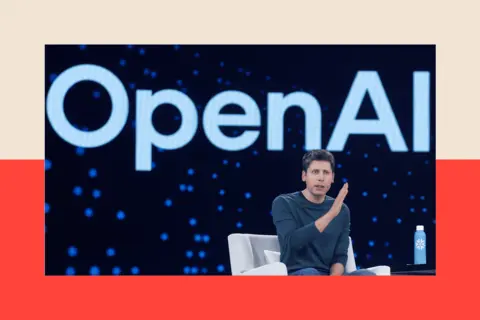

Bloomberg by way of Getty PicturesThe Financial institution of England has already warned of a “sudden correction” in international monetary markets, saying “market valuations seem stretched” for tech AI companies. In the meantime. OpenAI boss Sam Altman has speculated that “there are a lot of components of AI that I believe are type of bubbly proper now”.

Requested whether or not Google would be immune from a possible bubble burst, Mr Pichai mentioned it might climate that potential storm – however for all his starry-eyed pleasure across the prospects of AI, he additionally issued a warning: “I believe no firm goes to be immune, together with us.”

So why, then, is Google investing greater than $90bn a yr within the AI build-out, a three-fold improve in simply 4 years, on the very second these ideas are being mentioned?

The large AI surge – and the large danger

The AI surge – of which Google is only one half – is, in money phrases, the largest market growth the world has seen.

Its numbers are extraordinary – there may be $15 trillion of market worth at Google and 4 different tech giants whose headquarters are all inside a brief drive of each other.

Chipmaker turned AI methods pioneer Nvidia in Santa Clara is now price greater than $5 trillion. A ten-minute drive south, in Cupertino, is Apple HQ, hovering round $4 trillion; whereas quarter-hour west is $1.9 trillion Meta (beforehand Fb). And within the centre of San Francisco, OpenAI was just lately valued at $500bn.

The purely monetary penalties of this pattern are important sufficient.

The worth of the shares in these corporations (and some others outdoors Silicon Valley, akin to Microsoft in Seattle) have helped cushion the US economic system from the influence of commerce wars, and saved retirement plans and investments buoyant – and never simply within the US.

But it comes with an enormous danger. That’s, the unbelievable dependence of US inventory market progress on the efficiency of a handful of tech giants. The Magnificent 7 – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – collectively comprise one third of the valuation of America’s complete S&P 500.

And that market worth is now extra extremely concentrated in a number of companies than it was throughout the dotcom bubble in 1999, based on the IMF.

Mr Pichai factors out that each decade or so come these “inflection factors”: the private laptop, then the web within the late Nineties, adopted by cell and cloud. “Now it is clearly the period of Synthetic Intelligence.”

However as for the large query – is it a bubble?

Mr Pichai argues there are two methods of desirous about it. First, there may be “palpably thrilling” progress of providers that folks and corporations are utilizing.

However he concedes: “It is also true after we undergo these funding cycles, there are moments we overshoot collectively as an trade…

“So I believe it is each rational and there are components of irrationality by way of a second like this.”

Now, a distinction is rising within the markets between these companies that depend on typically borrowed cash and sophisticated offers to entry the chips that energy their AI, and the largest tech corporations, akin to Google, Microsoft and Amazon, which might fund funding in chips and information from their very own pockets.

Which brings us to Google’s personal silicon chips, or their prized TPUs.

‘Restricted’: contained in the silicon chip lab

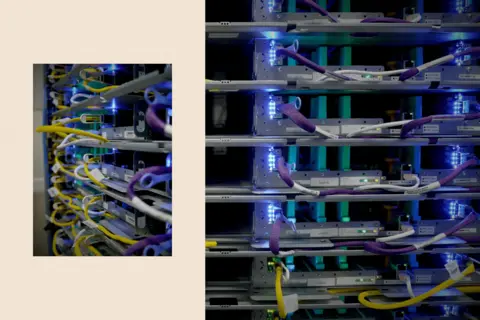

The lab, the place they’re examined, is the scale of a five-a-side soccer pitch with a mesh of multi-coloured wires and deep blue blinking lights. Indicators throughout learn: “restricted”.

What’s hanging is the sheer noise – that is right down to the cooling methods, that are wanted to assist management the temperature of the chips, which might get extremely sizzling when crunching trillions of calculations.

The TPUs are designed to assist energy AI machines. And so they work in another way from different varieties of chips.

The CPU (central processing unit) is the first part of a pc – primarily its mind – that performs many of the processing and management features, whereas GPUs (graphics processing items) carry out extra specialised processing, executing many parallel duties without delay – this may embody AI.

Nonetheless Asics (application-specific built-in circuits), are chips custom-built for a selected objective, for instance, a selected AI algorithm. And the TPU is a specialist Google-designed sort of Asic.

A core side of the AI growth has been the mad sprint to amass numerous top-performing chips and put them into information centres (or the bodily services that retailer, course of and run giant quantities of knowledge and software program).

Nvidia’s boss Jensen Huang as soon as coined the time period “AI factories” to explain the large information centres stuffed with pods and racks of tremendous chips, related to large vitality and cooling methods.

(Tech bosses akin to Mark Zuckerberg have referred to some being the scale of Manhattan. The Google TPU lab is considerably extra modest, testing out the know-how for deployment elsewhere.)

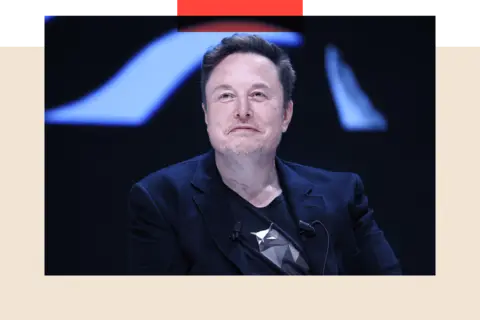

Tales abound of tech bros begging chip makers for a whole bunch of 1000’s of those extremely engineered items of silicon. Take the current dinner at Nobu in Palo Alto, the place Elon Musk and Larry Ellison, the founder and head of Oracle, tried to woo Nvidia’s Jensen Huang, to promote them extra of them.

As Mr Ellison put it: “I might describe the dinner as me and Elon begging Jensen for GPUs. Please take our cash – no, no take extra. You are not taking sufficient. We want you to take extra, please!”

It’s exactly the race to entry the facility of as many as attainable of those excessive efficiency chips, and to scale them up into large information centres, that’s driving an AI growth – and there is a notion that the one solution to win is to maintain spending.

The chips race – and the OpenAI storm

The terrace of the Rosewood Sand Hill lodge, a sprawling 16-acre property close to the Santa Cruz mountains that serves crab rolls and $35 signature vodka martinis, is the place the large Silicon Valley deal-making will get performed. It is near Stanford College and Meta’s HQ, in addition to the headquarters of main enterprise capital companies.

There are whispered rumours about who shall be subsequent to announce customised AI chips – Asics – to compete with Google and Nvidia.

Simply earlier than I visited, one thing of a storm was brewing concerning the funding plans of OpenAI, which Elon Musk co-founded.

The agency, which began as a not-for-profit however has since established a business construction, has been the main target of an internet of cross-investments involving shopping for up chips and different laptop {hardware} wanted for AI processing.

Few within the trade doubt OpenAI’s phenomenal person progress – particularly the recognition of its chatbot, ChatGPT. It has ambitions to design its personal {custom} AI chips, however some have speculated about whether or not it’d want authorities assist to attain this.

Getty Pictures

Getty PicturesIn a podcast episode that aired final month, an OpenAI investor questioned how the corporate’s spending commitments tallied with its revenues, to which co-founder Sam Altman shot again, difficult the income figures quoted, and including: “If you wish to promote your shares, I am going to discover you a purchaser. Sufficient.”

He has since shared a prolonged publish on X, explaining, amongst different issues, that OpenAI is taking a look at commitments of about $1.4 trillion over the subsequent eight years and why he believes now’s the time to spend money on scaling up their know-how.

“I don’t assume the federal government ought to be writing insurance coverage insurance policies for AI corporations,” he mentioned.

However he additionally mentioned: “What we do assume may make sense is governments constructing (and proudly owning) their very own AI infrastructure.”

Getty Pictures

Getty PicturesElsewhere, there have been notable very current falls in share costs of AI infrastructure corporations – Coreweave, a start-up that provides OpenAI, noticed its shares lose 26% of their worth earlier this month.

Plus, there have been some reactions in markets for perceived credit score danger amongst different companies. And whereas most of those tech share costs have usually climbed increased over the course of 2025, there was a light dip extra usually up to now few days.

ChatGPT versus Gemini 3.0

None of this has dampened the thrill over AI’s potential throughout the trade. Google’s client AI mannequin, Gemini 3.0, launched to nice fanfare earlier this week — this can pitch Google in a direct battle with OpenAI and its still-dominant ChatGPT for the market share.

What we do not but know is whether or not it marks an finish to the times of chatbots going rogue and recommending glue as a pizza ingredient. So, is the tip results of all this implausible funding is that info is much less dependable, I requested Mr Pichai.

“I believe should you solely assemble methods standalone and also you solely depend on that, [that] can be true,” he instructed me. “Which is why I believe we’ve got to make the knowledge ecosystem needs to be a lot richer than simply having AI know-how being the only product in it.”

However I put it to him that fact issues. His response: “fact issues”.

Neither is the opposite massive query dealing with tech right this moment dampening the passion round advancing AI’s potential. That’s: how on Earth to energy it?

By 2030, information centres all over the world will use about as a lot electrical energy as India did in 2023, based on the IMF. But that is additionally an age the place vitality provide is underneath stress by governments committing to local weather change targets.

I put this to Google’s Mr Pichai, asking whether it is coherent to have ambitions to generate 95% of electrical energy from low-carbon sources by 2030 – because the UK authorities does – and in addition be an AI superpower?

“I believe it is attainable. However I believe for each authorities, together with the UK, it is essential to determine methods to scale up infrastructure, together with vitality infrastructure.

“You do not wish to constrain an economic system based mostly on vitality,” he provides. “I believe that can have penalties.”

Classes from the 2000 dotcom bust

Years in the past, as a fledgling reporter I reduce my enamel within the 2000 dotcom bubble. It adopted a well-known speech by Federal Reserve Governor Alan Greenspan about “irrational exuberance”.

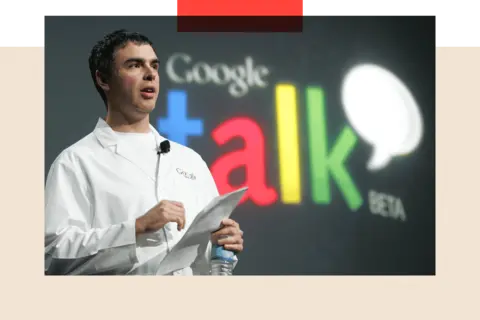

In that point I interviewed Steve Jobs twice, and some years later questioned Mr Pichai’s predecessor Larry Web page, and commentated stay on the collapse of WorldOfFruit.com.

By means of all of it, one lesson turned clear: that even within the worst-case eventualities and the hardest of crashes, disaster is not assured for all.

Take Amazon – its share worth slumped to $6 and its market capitalisation fell to $4bn throughout that crash, but some 25 years on Jeff Bezos and his firm are very a lot going robust. Right now Amazon is price $2.4 trillion.

The identical would, inevitably, be true of corporations shaken by a possible AI bubble burst.

WireImage

WireImagePlus there may be one other looming issue which will nicely clarify why so many in Silicon Valley – and past – are blind to, or maybe selecting to not, acknowledge this danger, and pushing on regardless.

That’s, the attraction of the glittering prize on the finish: attaining synthetic common intelligence (AGI).

That is the purpose at which machines match human intelligence, one thing many consider is inside attain. Or past that, reaching synthetic super-intelligence (ASI), the purpose at which machines surpass our intelligence.

However I used to be additionally instructed one thing else that was thought-provoking by a Silicon Valley determine – that it would not matter whether or not there actually is a bubble or if it bursts. Step again and what’s going on within the greater image is a world battle for AI supremacy, with the US towards China taking centre stage.

And whereas Beijing funds these developments centrally, within the US it’s a messy however productive free market free for all, which implies trial and error on an epic scale.

For now, the US has superiority in silicon over China – corporations like Nvidia with their GPUs and Google with their TPUs can afford to speed up into the storm.

Others will certainly fail, and spectacularly so, affecting markets, client sentiment and the world economic system. The bodily footprint left behind, nonetheless, containing sheer computing firepower for the deployment of mass AI applied sciences, will inevitably form our economic system and will nicely additionally form how we work and study – and who dominates the world for the remainder of the twenty first Century.

BBC InDepth is the house on the web site and app for one of the best evaluation, with contemporary views that problem assumptions and deep reporting on the largest problems with the day. Now you can join notifications that can provide you with a warning every time an InDepth story is revealed – click here to find out how.