Tesla’s income fell 71% over the primary three months of this 12 months, an organization earnings launch on Tuesday confirmed. The corporate’s efficiency fell wanting analysts’ expectations.

The decline coincided with a sales slump and stock woes on the electrical carmaker, and comes amid worldwide protests in opposition to CEO Elon Musk over his function within the Trump administration

Whole income decreased by 9% from one 12 months earlier, to $19.3 billion, whereas income derived from automotive gross sales plunged 20% over the primary three months of 2025 in comparison with a 12 months in the past, the earnings confirmed.

In an announcement, Tesla famous that “altering political sentiment” may impression demand for the corporate’s merchandise within the near-term.

Tesla additionally cautioned about enterprise impacts as results of the “present tariff panorama,” saying the corporate is “taking actions to stabilize the enterprise within the medium to long-term and concentrate on sustaining its well being.”

“Uncertainty within the automotive and vitality markets continues to extend as quickly evolving commerce coverage adversely impacts the worldwide provide chain and value construction of Tesla and our friends,” Tesla added.

The announcement holds implications for Musk, the world’s richest individual, who derives a lot of his wealth from his Tesla holdings.

The brand new monetary particulars arrive as some shareholders have referred to as on Musk to step down from his White Home function and return full-time to the helm of Tesla.

Musk, whose short-term standing as a authorities worker expires subsequent month, will possible face questions on his plans throughout a convention name with analysts after the earnings launch.

“We view this as a fork-in-the-road time,” Dan Ives, a managing director of fairness analysis on the funding agency Wedbush and a longtime Tesla booster, mentioned in a memo to traders on Sunday.

Tesla shares have dropped in worth by roughly half from an all-time excessive in December. Most of these losses have come since President Donald Trump took workplace and Musk started his controversial governmental cost-cutting efforts as the top of the newly created Department of Government Efficiency (DOGE).

Tesla stays a prime electrical carmaker however the firm faces rising competitors, particularly from Chinese language companies corresponding to BYD.

Deliveries of Tesla autos over the primary three months of 2025 dropped about 13% in comparison with the identical interval a 12 months in the past, the corporate mentioned earlier this month.

When Tesla introduced the decline in deliveries, the corporate made no point out of its CEO however did say {that a} “changeover of Mannequin Y traces throughout all 4 of our factories led to the lack of a number of weeks of manufacturing in Q1,” however added that “the ramp of the New Mannequin Y continues to go properly.”

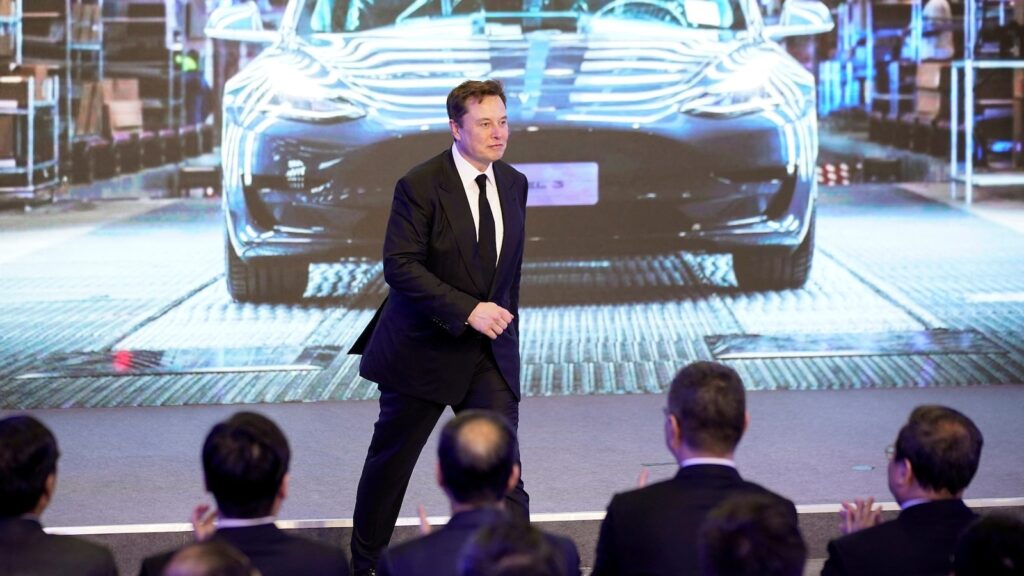

President Donald Trump talks to the media subsequent to Tesla CEO Elon Musk, with a Tesla automotive within the background, on the White Home in Washington, March 11, 2025.

Kevin Lamarque/Reuters

Tesla offered fewer vehicles in 2024 than it did the 12 months prior, marking the corporate’s first year-over-year gross sales decline in additional than a decade, earnings released in January showed.

As rivals have challenged Tesla’s dominance within the electrical automobile market, the corporate has promised a future income stream from autonomous taxis, often known as robotaxis.

Musk introduced in late January that the corporate would roll out its robotaxi check program in Austin, Texas, in June. However inside days, China-based competitor BYD unveiled advances in self-driving know-how, which the corporate mentioned was set to be included in fashions costing as little as $9,600.

Tesla boasts a extra full home provide chain than its rival U.S. carmakers however the firm stays susceptible to auto tariffs of the kind President Trump imposed earlier this month, in keeping with Musk.

“To be clear, this may have an effect on the worth of elements in Tesla vehicles that come from different international locations. The price impression just isn’t trivial,” Musk mentioned in a post on X in late March.

Gordon Johnson, CEO and founding father of information agency GLJ Analysis, who’s bearish on Tesla, voiced issues in regards to the firm in a memo to traders on Monday, saying that the automaker faces a mixture of “operational, monetary, and reputational challenges.”

“Is Tesla dealing with an existential disaster?” Johnson added.