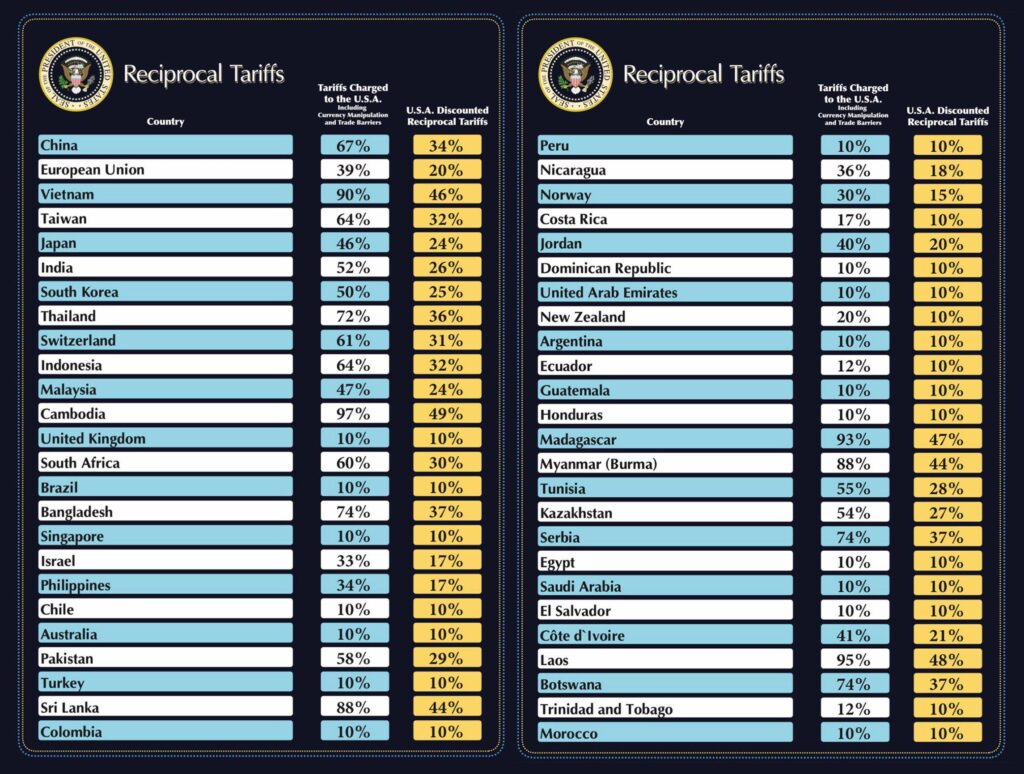

How did the Trump Administration provide you with these tariff charges? Why would a nation like Madagascar, for instance, with a small financial system, be hit with a 47% tariff? Reciprocal tariffs had been decided primarily based on America’s commerce deficit with different nations. They took every nation’s commerce surplus with the US by whole exports and divided that quantity by two, proclaiming we’re asking them for half of what they’ve been charging america.

The idea behind this methodology is {that a} commerce surplus means one nation is “taking benefit” of the opposite. Nonetheless, commerce imbalances don’t perform in such a cut-and-dry method. The US runs commerce deficits with some international locations whereas working surpluses with others. The worldwide financial system is interconnected, and imposing arbitrary tariffs primarily based on a deficit doesn’t mirror the broader image.

For instance, China could have a surplus with the US, however it additionally imports uncooked supplies from different nations to fabricate items. If the US locations a retaliatory tariff, it doesn’t essentially imply that China has been unfairly charging the US. China’s benefits of pure sources and decrease manufacturing prices is a part of the commerce deal. There’s a purpose the US and China had been one the most important buying and selling companions, as China relied on American customers the identical manner that America relied on cheaper Chinese language items. China was then investing in US debt, which it as soon as considered as a secure commerce, however that’s not the case, and America will endure because of this. All of those measures are inflicting America’s buying and selling companions to flee.

Take a look at Canada, the place the inhabitants is much smaller than America’s, which is considered one of many variables. There’s much less demand general and whereas Canada relied on the US for quite a few imports, America was not subsidizing Canada. A commerce deficit shouldn’t be a subsidy! The US pays for Canadian items and companies with USD, which Canada then reinvests within the US financial system. That is how international commerce works; it’s not a one-way road the place Canada merely takes benefit of the US.

We can not count on a whole stability in buying and selling. Take a look at poorer nations—they merely may by no means buy the identical quantity from America. Wages in these nations are far lower than the US minimal wage, and thus, manufacturing is cheaper from a labor standpoint alone. For instance, nobody from Cambodia can be in search of an American-made automotive. A Cambodian manufacturing facility is not going to transfer operations to the US to keep away from the 49% tariff. They are going to search for various patrons exterior of the US. Imbalances are a pure a part of commerce. Treasury Secretary Bessent stated, “Let them eat flat screens,” however that’s not the core of the problem. People did take pleasure in cheaper items, however the larger situation is that these tariffs make American investments LESS enticing as main firms can not function from a purely home standpoint.

The calculations don’t consider forex exchanges. Capital flows and forex values typically affect commerce deficits. If international capital flows into the US to purchase Treasury bonds, actual property, or equities, it strengthens the USD, making US exports costlier and imports cheaper. This isn’t a perform of unfair commerce practices however of the worldwide demand for US property.

By imposing tariffs arbitrarily, the price of imported items rises, which might negatively affect home industries who depend on these items. Most American producers depend on international items to function or finalize their “Made in America” merchandise. Climbing up tariffs will trigger the price of manufacturing to soar. The workforce will shrink as income lower. Shoppers bear the brunt of those insurance policies by means of increased costs.

The idea that tariffs needs to be decided by “half of the excess” rule ignores the truth that commerce wars usually are not linear. These tariffs are NOT “reciprocal” because the Trump Administration insists. They aren’t wanting on the precise tariffs set by different nations. These advising Trump imagine that different international locations will wish to negotiate “tariffs” to allow free commerce, however as a substitute they’re merely hoping to shut commerce deficits, and that merely can not happen. Thursday’s sell-off is indicative of capital flowing out of the US. The Trump Administration principally advised the world that America is closed for worldwide enterprise, and capital is responding to the risk. The true affect of those tariffs will quickly come as we transfer deeper right into a interval of stagflation.