Keep knowledgeable with free updates

Merely signal as much as the US inflation myFT Digest — delivered on to your inbox.

US shares and bonds rallied after knowledge revealed on Wednesday confirmed underlying worth pressures on the planet’s largest financial system easing greater than anticipated, prompting traders to wager on swifter rate of interest cuts this 12 months.

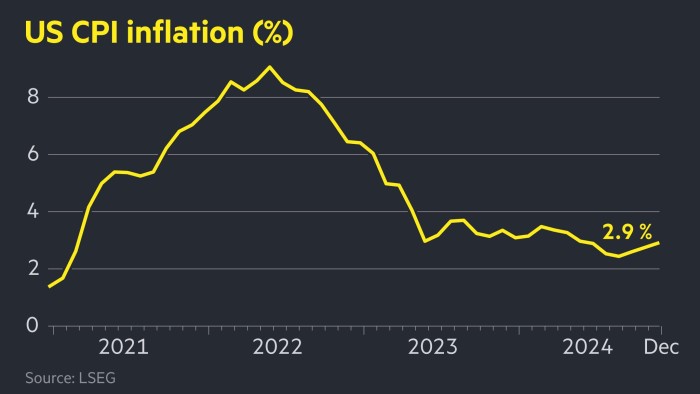

The figures from the Bureau of Labor Statistics indicated that headline annual inflation rose in keeping with expectations to 2.9 per cent in December from 2.7 per cent in November.

However core inflation, which strips out risky meals and vitality prices, fell unexpectedly to three.2 per cent from 3.3 per cent a month earlier than.

US equities and Treasuries gained after the info launch. Markets had dipped in current weeks as traders scaled again expectations of Federal Reserve fee cuts in anticipation of president-elect Donald Trump’s financial coverage, which some concern might be inflationary.

“Immediately’s CPI ought to present a lift to markets, relieving a few of the nervousness that the US is at the start levels of a second inflation wave,” mentioned Seema Shah, chief world strategist at Principal Asset Administration.

Shares and authorities bonds rallied sharply following Wednesday’s inflation knowledge.

The S&P 500 jumped 1.4 per cent on the open, whereas the tech-heavy Nasdaq Composite leapt 1.8 per cent. The positive factors put shares on the right track for his or her greatest day since November 6, after Trump gained the US presidential election.

The policy-sensitive two-year Treasury yield, which intently tracks rate of interest expectations, misplaced 0.1 proportion level to commerce at 4.26 per cent, whereas the 10-year yield — a benchmark for world borrowing prices — tumbled 0.13 proportion factors to 4.66 per cent. Yields fall as costs rise.

A gauge of the greenback towards six friends fell 0.6 per cent.

As of Wednesday morning, traders have been betting that the Fed would lower charges by July, in contrast with September earlier than the info was revealed. The chance of a second lower this 12 months implied by futures markets climbed to roughly 60 per cent from about 20 per cent earlier on Wednesday.

Fed officers have signalled that they plan to take a “cautious strategy” to fee cuts amid considerations that inflation might not shortly come right down to the central financial institution’s 2 per cent goal.

Mark Cabana, head of US charges technique at Financial institution of America, mentioned that the inflation figures, notably the core determine, have been prone to “modestly improve” the Fed’s “confidence that inflation will proceed to fall”. However he added that policymakers have been most likely “nonetheless general annoyed with the slowdown within the tempo of progress on the inflation entrance”.

Most traders and analysts consider the Fed is not going to decrease charges once more at its subsequent coverage assembly later this month. US central bankers have signalled in their very own projections that they are going to solely lower charges by an extra 50 foundation factors this 12 months.

Trump, who takes workplace on Monday, has laid out aggressive plans to impose tariffs on an unlimited swath of imports, implement an enormous crackdown on undocumented immigrants and enact sweeping tax cuts.

Economists have warned such plans might increase inflation additional.

“The actual query mark round inflation this 12 months isn’t round what the financial system can do to inflation or what the development is earlier than the Trump administration takes over,” mentioned David Kelly, chief world strategist at JPMorgan Asset Administration. “It’s what is going to new insurance policies on tariffs, immigration and financial insurance policies imply for inflation?”