Unlock the White Home Watch e-newsletter without spending a dime

Your information to what Trump’s second time period means for Washington, enterprise and the world

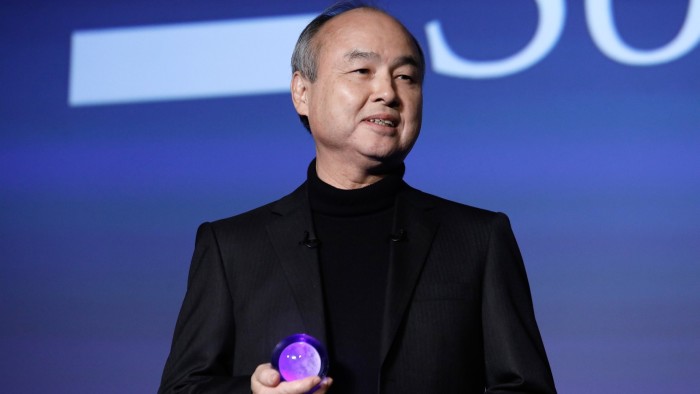

SoftBank founder Masayoshi Son has floated the concept of making a joint US-Japan sovereign wealth fund to make large-scale investments in tech and infrastructure throughout the US.

The concept has been raised on the highest political ranges in Washington and Tokyo, in accordance with three individuals near the state of affairs, and will develop into a template for different governments to forge nearer funding ties with the US.

The plan, which has been mentioned straight between Son and US Treasury Secretary Scott Bessent and outlined to different prime authorities figures in each international locations, has not but crystallised into a proper proposal, in accordance with three individuals near the state of affairs.

The joint fund concept has been raised a number of instances in latest weeks, nevertheless, as Japanese negotiators and the Trump administration edge in the direction of a commerce deal. Japan has dug right into a place the place it would push for zero tariffs, whereas the US aspect has made it clear that it’ll go no decrease than its “baseline” tariff of 10 per cent.

However following a name between Donald Trump and Japanese Prime Minister Shigeru Ishiba on Friday, the latter instructed home media he now anticipated {that a} deliberate assembly between the 2 on the sidelines of the G7 assembly in Canada in mid-June could be a “milestone” in negotiations.

Beneath the recommended wealth fund construction, the US Treasury and the Japanese ministry of finance could be joint homeowners and operators of the fund, every with a big stake. They’d then open the automobile to different restricted associate traders, and will doubtlessly supply odd Individuals and Japanese the possibility to personal a slice.

One individual accustomed to the discussions mentioned that to be efficient in its funding ambitions the fund must be “monumental” — with doubtlessly $300bn in preliminary capital after which closely leveraged.

The enchantment of the joint fund would stem from its capability to ship a income stream to each governments, in accordance with individuals briefed on its particulars.

“The idea is that Bessent is on the lookout for income streams for the Treasury that don’t contain elevating taxes, and nevertheless far out this joint fund might sound, it could in idea present that,” mentioned one individual briefed on the state of affairs who added that the concept had been pitched as marking a transparent break with earlier methods.

The individual added that they believed Bessent “needs one thing that may develop into the blueprint for a brand new sovereign-to-sovereign monetary structure, whereas Japan needs a correctly ruled covenant that protects Japan from the advert hoc choices of Oval Workplace politics.”

Up to now, the individual added, the US authorities, or particular person state, would supply tax incentives for large direct traders to construct factories or infrastructure tasks. The expectation behind that technique was that authorities would not directly obtain tax in some unspecified time in the future. However funding made by the envisaged joint fund would straight ship income in proportion to the unique funding.

Son is near Trump and was a outstanding customer to the incoming president’s Mar-a-Lago dwelling in December. He has been central to the joint fund proposal, mentioned the 2 individuals near the state of affairs, doubtlessly hoping that he would finally play a task in directing the fund’s funding choices.

The SoftBank boss is used to creating high-stakes bets and stood beside Trump in January to unveil his $500bn Stargate plan to construct US information centres and synthetic intelligence infrastructure with OpenAI and Oracle. It’s the type of challenge that might appeal to funding from the proposed wealth fund, mentioned one of many individuals accustomed to Son’s pondering.

A spokesperson for the Treasury declined to remark. SoftBank declined to remark.