Ask what—if something—is holding again the AI trade, and the reply you get relies upon so much on who you’re speaking to. I requested one in every of Bloomberg’s former chief knowledge wranglers, Carmen Li, and her reply was “worth transparency.”

Based on Li, the shortcoming of many of the smaller AI firms to foretell how a lot they might want to spend for the privilege of renting time on a GPU to coach their fashions makes their companies unpredictable and has made financing AI firms unnecessarily costly. She based the startup Silicon Data to create an answer: the primary world-wide rental worth index for a GPU.

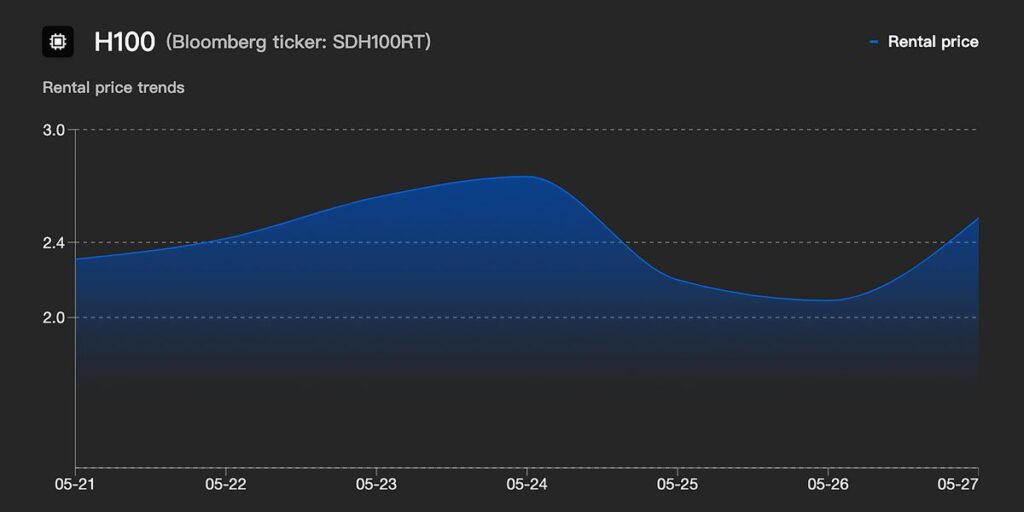

That rental worth index, referred to as the SDH100RT, launched as we speak. On daily basis, it’s going to crunch 3.5 million knowledge factors from greater than 30 sources all over the world to ship a mean spot rental worth for utilizing an Nvidia H100 GPU for an hour. (“Spot worth” is what a commodity to be delivered instantly sells for proper now.)

“I actually consider compute would be the largest useful resource for humanity within the subsequent few years,” says Li. “If my thesis is correct, then it’s going to want extra refined danger administration.”

Based on Li, such an index will result in cheaper AI instruments and extra alternatives for a wider set of gamers to become involved within the AI trade. How do you get from an index to all that? Silicon Information’s origin story helps clarify it.

US $1.04: Rental worth benefit for Nvidia H100 GPUs on the East Coast of the United States versus these on the West Coast.

Till early final yr, Li was in command of world knowledge integration at Bloomberg. In that place she met with a number of small firms that had been making an attempt to ship AI-fueled knowledge merchandise, and lots of of them had been fighting the identical downside. They might solely provide their product at a set price, however the price of the GPU-time they wanted was unpredictable. Due to this fact, so had been their revenue margins.

With typical commodities like vitality, firms can plan for these swings by realizing historic traits and hedging with monetary merchandise like futures contracts. However that didn’t exist for AI’s most important commodity, time on a GPU. So Li got down to create the inspiration for these merchandise, and the result’s the SDH100RT worth index.

She selected to index the Nvidia H100, as a result of it’s essentially the most extensively deployed GPU, and it’s used to coach new AI models. Nonetheless, a worth index for Nvidia A100s, which sort out a number of inference duties, is within the works as nicely. And he or she’s developed a way that may decide when it is sensible to index costs for different AI chips, reminiscent of these from AMD and Nvidia’s Blackwell sequence.

Carmen Li based Silicon Information after a stint at Bloomberg.Silicon Information

Armed with the information, startups and others constructing new AI merchandise will have the ability to perceive their potential prices higher, to allow them to set their companies at a worthwhile worth. And people constructing new AI infrastructure will have the ability to set a benchmark for their very own income. However simply as vital, in Li’s opinion, is that new sources of capital can become involved within the AI area.

Banks, for instance, are a comparatively cheap provider of capital, notes Li. However as a result of they’ve strict danger controls and there hasn’t been sufficient GPU worth knowledge, they haven’t been ready to fund AI tasks. Li hopes that the SDH100RT will let banks lend to a wider set of gamers within the AI trade and permit them to provide you with monetary merchandise that scale back the chance for these already in it.

Insights and Oddities from the Information

Though it launched as we speak, Silicon Information has been monitoring GPU rental costs for months. As you may count on, having a window into the value of AI coaching has unveiled some attention-grabbing insights. What follows are some things Li has found. (She’s been publishing these analyses on the common since final September.)

East Coast guidelines! West Coast drools: H100 rental pricing could be very secure in america, however there’s a persistent East Coast advantage. In March you possibly can get an hour of labor from an H100 on the East Coast for US $5.76. However that very same hour would value you $6.80 on the West Coast.

Hyperscaler chips assist: Amazon Internet Service’s foray into designing its own chips and servers has lowered prices for the cloud large’s clients. Based on Silicon Information, at about $4.80 per hour the typical unit worth per GPU for AWS’s Trainium2 is lower than half the value for utilizing an Nvidia H100. Its first technology chips Inferentia and Trainium each are available at lower than $1.50 per hour, which is lower than half the value of as we speak’s inference workhorse, the Nvidia A100. Nonetheless, H100s are considered the one choice for cutting-edge mannequin coaching, so their efficiency may justify the additional scratch.

DeepSeek’s modest impact: January’s Deepseek shock did little to the spot rental worth. It’s possible you’ll recall that the efficiency and reported low-cost training of Hangzhou-based DeepSeek’s LLMs took many unexpectedly and despatched AI-related shares right into a patch of pearl clutching. “When DeepSeek got here out, the [stock] market went nuts,” says Li. “However the spot worth didn’t change a lot.” On DeepSeek’s debut the H100 worth went up mildly to $2.50 per hour, however that was nonetheless within the $2.40 per hour to $2.60 per hour vary from the months earlier than. It then slid to $2.30 per hour for a lot of February earlier than it began climbing once more.

Intel is Extra Posh Than AMD: GPUs are all the time underneath the management of CPUs, often in a 4:1 ratio. And the marketplace for that CPU spot is contested between Intel and AMD. (Nvidia additionally makes its personal CPU, referred to as Grace.) Nevertheless it appears clients are keen to pay a little bit of a premium for Intel-powered techniques. For Nvidia A100 techniques, these with Intel CPUs fetched a few 40 p.c greater worth than these with AMD processors. For the H100, the impact trusted the interconnect expertise concerned. If a pc used SXM or PCIe as its hyperlinks, Intel fetched a better worth. However for these utilizing Nvidia’s NVLink interconnect scheme, AMD acquired the premium.

The Commoditization of AI

Can you actually boil the value of AI right down to a single quantity? In spite of everything, there are such a lot of components concerned in a pc’s efficiency and its utility to a selected buyer. For instance, a buyer may be coaching with knowledge that can’t, for authorized causes, cross worldwide borders. So why ought to they care concerning the worth out of the country? And, as anybody who has examined machine studying’s main benchmark outcomes, MLPerf, can see, the efficiency of the identical Nvidia GPU can range extensively relying on the system it’s in and the software program it’s working.

Based on Li, the commodity view can work. Silicon Information’s index normalizes all these variations and provides totally different weights to issues like how a lot an information heart participates within the rental market, its location, its knowledge sources, and lots of many different issues.

Maybe the most important endorsement of the thought of AI as a commodity is from Nvidia CEO Jensen Huang himself. On the firm’s massive developer occasion, GTC, he pushed for pondering of data centers as “AI factories” whose output can be measured in what number of tokens, the smallest unit of knowledge an LLM makes use of, they will produce per second.

From Your Web site Articles

Associated Articles Across the Internet