Authorities attorneys representing the performing director of the Client Finance Safety Bureau reached an settlement throughout a courtroom convention Friday to quickly maintain off on firing CFPB employees en masse whereas a lawsuit difficult the dismantling of the company makes its approach by way of courtroom.

The consent order blocks the CFPB from firing workers for causes unrelated to their work efficiency or conduct, and prevents the Trump administration from making an attempt to redirect funding away from the company tasked with defending shoppers.

The settlement additionally prevents the Trump administration from destroying or altering delicate data maintained by the CFPB.

U.S. District Decide Amy Berman Jackson stated she’s going to think about issuing a longer-term preliminary injunction throughout a courtroom listening to on March 3.

The ruling got here after the CFPB had fired its probationary staff as a part of the Trump administration’s government-wide layoffs, with a lot of the remaining workers anticipating to be fired subsequent.

A gaggle of federal unions that’s suing the Trump administration over its dismantling of the agency alleged in a courtroom submitting Thursday that Russell Vought, newly put in as performing director, deliberate to purge over 95% of the company’s workforce as quickly as Friday.

The plaintiffs who introduced the lawsuit requested Berman to impose a brief order to dam the dismantling the CFPB, which they argue might have sweeping penalties for American shoppers.

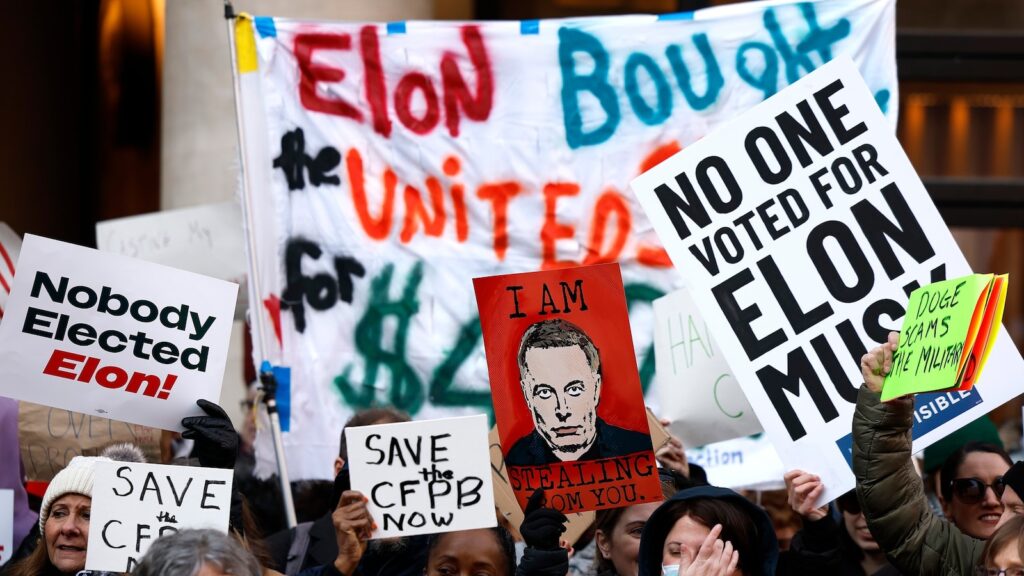

WASHINGTON, DC – FEBRUARY 10: Protesters rally exterior the Client Monetary Safety Bureau (CFPB) on February 10, 2025 in Washington, DC. Lawmakers, federal staff and supporters participated in a protest in opposition to Elon Musk and the Division of Authorities Effectivity’s (DOGE) plan to close down the buyer watchdog company. (Photograph by Anna Moneymaker/Getty Photographs) ***BESTPIX***

Anna Moneymaker/Getty Photographs

The firings, a part of President Donald Trump’s marketing campaign pledge to slash the federal government, would intestine the 1,700-employee shopper watchdog company, in keeping with three CFPB workers who spoke to ABC Information on the situation that they to not be recognized out of worry of retribution.

“All time period workers have been fired tonight, and it seems to be like the remainder of us can be fired tomorrow however for trigger reasonably than by way of a RIF [reduction in force] which implies no severance I feel,” one company lawyer wrote in a message to ABC Information.

“3 of my 4 teammates have been canned,” one other worker wrote. “Simply me and my supervisor left, the one everlasting workers.”

Workers have been advised to not work or go into the company’s Washington, D.C., headquarters this week, and several other workers stated their credentials didn’t enable entry into satellite tv for pc places of work in San Francisco, Chicago, New York and Atlanta on Thursday, two of the staff stated.

The CFPB was created in 2011 as a response to the 2008 monetary disaster which was brought on by large investments primarily based on subprime or dangerous mortgages, inflicting a worldwide monetary disaster amid an absence of oversight.

The staff ABC Information spoke with stated the firings will go away all Individuals extra susceptible.

“I’m anxious about everyone. What in regards to the individuals who use our complaints to get their loans straightened out or their financial institution accounts unfrozen? They’ve already tried calling the corporate and gotten nowhere,” an worker wrote. “Who will assist them now? Will the businesses get daring and screw over their clients with out our strong oversight?”

“It may be a nightmare,” the worker stated.

“I am involved for each shopper on the market,” one other worker advised ABC Information. “There’s a number of fintech firms and I do not know what is going on to occur if we do not have purview over that.”

The worker stated she was additionally involved about X CEO Elon Musk, the top of the Department of Government Efficiency, accessing the CFPB’s large database, which comprises details about firms that Musk’s deliberate “X Cash” on-line cost service would compete with. The company would even be liable for regulating the X Cash platform.

The worker additionally stated she was alarmed on the approach CFPB workers have been being characterised by the Trump administration.

“Lots of people are actively giving again and serving” the neighborhood, she stated of her fellow CFPB workers. “Some donate from our paychecks — donations for nonprofits, volunteering, donating, giving again to our neighborhood, fostering canines, they’re concerned in a number of causes. I work with outstanding individuals who by no means cease serving.”

“Me personally, this was my dream job in faculty and I am unable to even consider i obtained in, it was so aggressive,” wrote the worker, who stated she is in her fourth 12 months on the company after having labored within the personal sector, so her pension is not going to vest. “It is the dream job, what’s subsequent? I am too younger to retire, I consider within the work we did, everybody I work with felt the identical.”