Unlock the White Home Watch publication without cost

Your information to what the 2024 US election means for Washington and the world

Treasuries dropped on Friday in risky buying and selling, as market contributors warned of rising strains within the $29tn marketplace for US authorities debt.

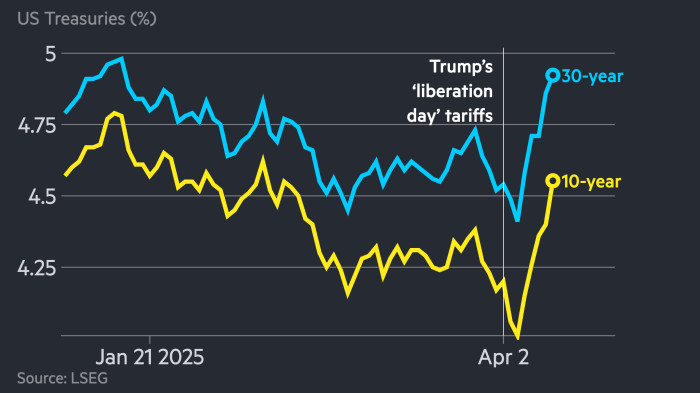

The ten-year Treasury yield climbed as a lot as 0.19 proportion factors to 4.58 per cent on Friday, amid a deepening droop for an asset historically thought of the worldwide monetary system’s premier haven.

The yield later reversed a few of these positive aspects to commerce at 4.48 per cent after Boston Fed President Susan Collins told the Monetary Instances the US central financial institution “would completely be ready” to deploy its firepower to stabilise monetary markets ought to situations change into disorderly.

President Donald Trump’s erratic tariff policies have shaken traders’ religion in US policymaking and the economic system, sparking an exodus from American property. The ten-year yield rose nearly 0.5 proportion factors this week, the most important rise since 2001, in line with Bloomberg information.

Whereas Trump backed down from his so-called reciprocal tariffs on non-retaliating international locations earlier this week — agreeing to a 90-day hiatus for many main US buying and selling companions — he positioned steeper levies on Chinese language imports.

“There may be actual stress throughout the globe to promote Treasuries and company bonds if you’re a international holder,” mentioned Peter Tchir, head of US macro technique at Academy Securities. “There’s a actual international concern that they don’t know the place Trump goes.”

“We’re involved as a result of the actions you see level to one thing else apart from a standard sell-off,” mentioned a European financial institution government in prime providers, a division that facilitates leveraged buying and selling for companies together with proprietary merchants and hedge funds. “They level to a whole lack of religion within the strongest bond market on this planet.”

Merchants mentioned poor liquidity — the benefit with which traders should purchase and promote Treasuries with out transferring costs — was exacerbating market strikes.

Analysts at JPMorgan mentioned market depth, a measure of the market’s capacity to soak up giant trades with out vital shifts in value, had considerably worsened this week, that means even small trades had been transferring yields considerably.

As he travelled to his Mar-a-Lago resort on Friday, Trump mentioned: “The bond market’s going good. It had a bit second, however I solved that drawback in a short time.”

When requested to what extent the bond market factored into his 90-day pause of reciprocal tariffs to non-retaliating international locations, the president prompt it didn’t, regardless of saying so earlier within the week. “I need to put the nation in an unbelievable financial place. Which is the place we must be,” he mentioned.

The top of Treasury buying and selling at a significant US bond supervisor mentioned liquidity was “not nice at present” and defined that “market depth was operating 80 per cent under regular averages” on Friday.

“If a stiff breeze blew via the Treasury market at present, charges would transfer 1 / 4 level,” added Man LeBas, chief fixed-income strategist at Janney Montgomery Scott.

Friday’s Treasury volatility was accompanied by a drop within the greenback.

A gauge of the foreign money’s energy towards main friends fell as a lot as 1.8 per cent on Friday. Sterling, the Japanese yen and the Swiss franc all made vital positive aspects.

Trump mentioned of the greenback: “We’re the foreign money of selection. We’re all the time going to be . . . I believe the greenback is great.”