For greater than twenty years, the U.S.-China buying and selling relationship has been on the heart of globalization’s story: low-cost items for American customers, speedy development for China and an intricate internet of provide chains binding the world’s two largest economies collectively. The Chinese language folks — hardworking, modern and industrious — have been important companions in that story.

However financial relationships are strategic selections. What as soon as appeared like a path towards shared prosperity has change into a structural imbalance that weakens America’s autonomy. It’s time to finish our extreme buying and selling reliance on China — not over international tensions or hostility, however for the sake of pragmatism.

This isn’t an argument in opposition to international commerce or ending relations with China. It’s an argument for higher commerce. It’s about reinforcing — not rebuilding — America’s financial power by deepening our engagement with democratic, market-based nations whereas decreasing publicity to a single authoritarian energy that wields disproportionate leverage over our economic system.

The financial info are stark. In 2024, U.S. exports to China totaled roughly $143 billion, whereas imports from China reached nearly $439 billion. That imbalance produced a commerce deficit of greater than $295 billion — the biggest bilateral deficit the U.S. maintains. Complete commerce between the 2 international locations approached $659 billion. Some economists have argued that giant and chronic deficits with China have contributed to U.S. job losses since China’s accession to the World Commerce Group in December 2001.

Such numbers won’t matter if commerce had been evenly distributed throughout sectors and companions. However a lot of this dependence is concentrated in strategically delicate industries. Nowhere is that this extra harmful than with uncommon earth components, that are crucial to almost each superior expertise, from semiconductors, electrical automobiles, wind generators and smartphones to radars and precision-guided protection methods. China additionally accounts for almost all of uncommon earth manufacturing and almost 90% of its processing worldwide.

For years, importing these supplies from China appeared cheaper than producing them at residence or working with allied suppliers. However a low worth doesn’t guarantee safety. A single coverage choice from Beijing, for instance, may ship shockwaves by means of U.S. protection manufacturing, clear vitality industries and plenty of industrial provide chains.

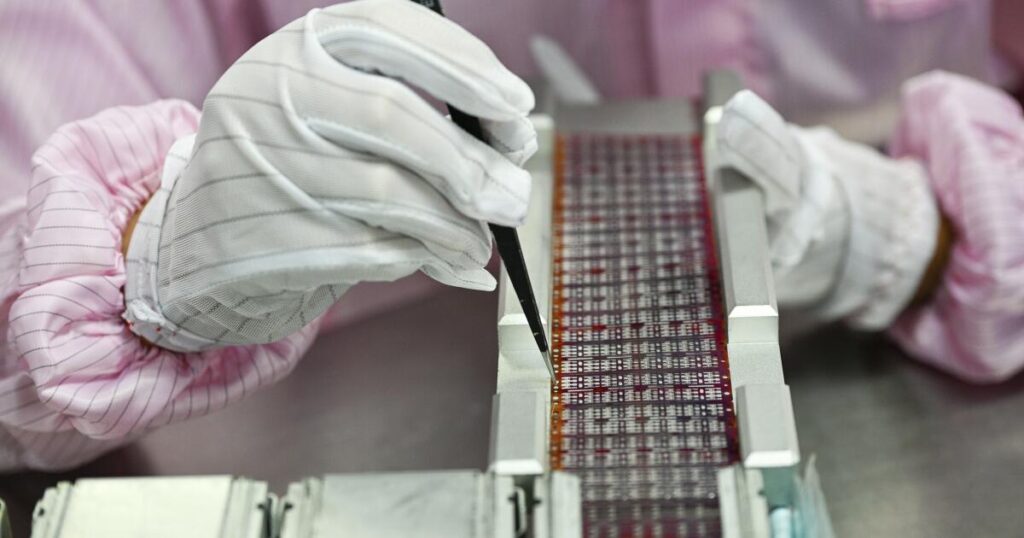

Lately, Chinese language export restrictions on gallium and germanium have rattled international electronics provide chains. When the pandemic hit in 2020, American hospitals scrambled to supply protecting gear from factories hundreds of miles away. This dependence isn’t merely an financial danger — it’s a strategic vulnerability, because it impacts provide chains and distorts the coverage selections we make. When mission-critical industries depend on inputs managed by an authoritarian state, financial reliance can flip into political leverage.

There’s one other, usually missed consequence of our commerce relationship with China: monetary market volatility. During the last decade, U.S. inventory markets have repeatedly swung on information of tariff bulletins and tensions between the superpowers. Traders know that any signal of hassle within the U.S.-China relationship can threaten company earnings and enhance market volatility. In contrast, commerce with steady democratic companions is much less susceptible to abrupt political shocks. Diversifying and balancing commerce towards democratic, market-oriented nations would probably scale back the frequency and depth of those market gyrations, providing better predictability for firms and their buyers.

The U.S. has all the time thrived in open economies ruled by honest competitors. The best response to our present problem is deeper engagement with nations that share these ideas — international locations like Japan, Australia, England, Canada, Mexico, the Philippines, South Korea and member states of the EU. Many of those buying and selling companions are already investing in new uncommon earth provide chains and different crucial industries to scale back overreliance on China. By working collectively persistently over an extended time period, democratic nations can create diversified, impartial markets that improve collective safety and competitiveness.

The identical logic extends past minerals. Strategic industries — semiconductors, prescription drugs, auto manufacturing, vitality elements and medical provides — ought to be anchored at residence amongst trusted companions. A globally networked system rooted in open markets and shared guidelines isn’t solely safer than dependence on a single nation but additionally extra modern, extra inclusive, extra resilient and extra steady. And it could assist higher insulate international monetary markets from geopolitical shocks tied to a mercurial bilateral relationship.

Critics name efforts to scale back reliance on China “decoupling,” as if it means turning inward. That’s not true. Abating its overreliance on China commerce will reaffirm U.S. management in free and open markets and can assist the U.S. and its allies higher align their financial methods with market transparency and long-term safety. Delaying these steps solely raises the price. Every year of dependence deepens the imbalance and narrows America’s flexibility. Uncommon earths will be the clearest instance, however they’re hardly the one one. Focus in China reaches throughout many areas of producing, creating dangers the U.S. can now not ignore.

The Chinese language folks will proceed to prosper and innovate, simply as they need to. However the U.S., over time, should chart its personal course — one which’s safer and economically principled. Which means reinforcing home capability in industries the place it issues most and constructing deeper, freer commerce relationships with democratic, market-based companions that complement our core competencies.

Ending our overwhelming reliance on China for commerce and commerce doesn’t imply ending the connection. Many ties present between our two international locations, which have been cultivated since President Nixon’s 1972 go to to Beijing, ought to in fact proceed to each nations’ profit.

The present commerce relationship with China is now not constructive. Making change will take time — effectively greater than a decade — and would require an excellent dedication. However ending that harmful dependence, and embracing new, open markets with trusted allies, is a renewal that’s lengthy overdue, and one that may make all of the distinction as we navigate the uncharted waters of the twenty first century.

Christian B. Teeter teaches international enterprise and worldwide economics at Mount Saint Mary’s College in Los Angeles.