Priti GuptaExpertise Reporter

Tejas Networks

Tejas NetworksA dependable provide of laptop chips is crucial for Arnob Roy, the co-founder of Tejas Networks.

His firm, based mostly in Bangalore, India, provides the gear behind cell phone networks and broadband connections.

“Basically, we offer the electronics that carry site visitors throughout telecom networks,” he says.

That requires particular chips designed for telecoms duties.

“Telecom chips are basically totally different from shopper or smartphone chips. They deal with huge volumes of knowledge coming concurrently from lots of of hundreds of customers.

“These networks can’t go down. Reliability, redundancy and fail-safe operation are essential – the chip structure has to assist that,” Roy says.

Tejas designs lots of these chips in India, a rustic well-known for its experience in designing laptop chips (also called semiconductors).

It is estimated that 20% of the world’s semiconductor engineers are in India.

“Nearly each main international chip firm has its largest or second-largest design centre in India, engaged on cutting-edge merchandise,” says Amitesh Kumar Sinha, Joint Secretary of India’s Ministry of Electronics and Info Expertise.

What India lacks is corporations that manufacture semiconductors.

So Indian companies like Tejas Neworks design the chips they want in India, however then have them manufactured abroad.

The weak point of that system was exposed during Covid, when the availability of chips dried up and corporations in all kinds of industries needed to cut back manufacturing.

“The pandemic made it clear that semiconductor manufacturing is simply too concentrated globally, and that focus carries critical danger,” Roy says.

That spurred India to develop its personal semiconductor trade.

“Covid confirmed us how fragile international provide chains may be. If one a part of the world shuts down, electronics manufacturing all over the place is disrupted,” says Sinha.

“That is why India is creating its personal semiconductor ecosystem to scale back danger and enhance resilience,” he provides.

He’s main authorities efforts to develop the semiconductor trade, which includes figuring out elements of the manufacturing course of the place India can compete.

Getty Photos

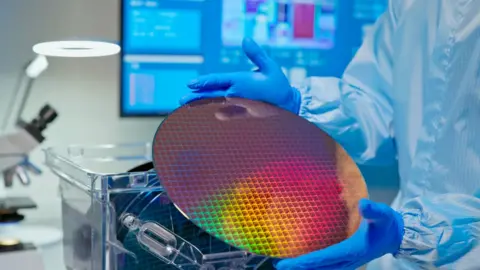

Getty PhotosThere are several steps in making a computer chip. First design, the place India is already robust.

The second stage is wafer fabrication, the place skinny sheets of silicon have circuits etched on to them by extraordinarily costly machines in big factories often called semiconductor “fabs”.

That a part of the method, significantly for essentially the most refined chips, is dominated by corporations in Taiwan, with China attempting to catch up.

Within the third stage these massive silicon wafers are sliced up into particular person chips, packaged in protecting casing, related to contacts and examined.

That third stage, often called Outsourced Semiconductor Meeting and Check (Osat), is the a part of the manufacturing course of focused by India.

“Meeting, take a look at and packaging are simpler to begin than fabs and that’s the place India is shifting first,” says Ashok Chandak, president of India Electronics and Semiconductor Affiliation (IESA).

He says that a number of such vegetation will “enter mass manufacturing” this 12 months.

Getty Photos

Getty PhotosBased in 2023, Kaynes Semicon is the primary firm to get a semiconductor plant up and operating with assist from the Indian authorities.

Kaynes Semicon invested $260m (£270m) in a manufacturing unit to assemble and take a look at laptop chips within the northwestern state of Gujarat. Manufacturing began in November of final 12 months.

“Packaging is not only placing a chip in a field. It is a 10 to 12 step manufacturing course of,” says Raghu Panicker, CEO of Kaynes Semicon.

“That is why packaging and testing are as essential as making the chip itself with out this stage, the wafer is ineffective to trade.”

His facility is not going to be making essentially the most superior laptop chips discovered within the newest cellphones or used for coaching AI.

“India doesn’t want essentially the most complicated datacentre or AI chips on day one. That’s not the place our demand is, and that’s not the place our power lies immediately,” Panicker says.

As a substitute, they would be the type of chips utilized in vehicles, telecoms and the defence trade.

“These should not glamorous chips, however they’re economically and strategically much more essential for India. You construct an trade by first serving your individual market. Complexity can come later. Scale has to return first,” he provides.

It has been a steep studying curve for Kaynes Semicon.

“We had by no means constructed a semiconductor cleanroom in India earlier than. We had by no means put in this gear earlier than. We had by no means skilled folks for this earlier than,” Panicker says.

“Semiconductors demand a degree of self-discipline, documentation and course of management that could be very totally different from conventional manufacturing. That cultural shift is as essential because the technical one.”

Getting workers skilled has been an enormous problem.

“Coaching takes time. You can’t shortcut 5 years of expertise into six months. That’s the single largest bottleneck,” Panicker says.

Again in Bangalore, at Tejas Networks, Arnob Roy is trying ahead to purchasing extra locally-sourced tech.

“Over the subsequent decade, we anticipate a big semiconductor manufacturing base to emerge in India and that can instantly assist corporations like ours.”

It is the beginning of an extended journey, he says.

“I do see Indian corporations finally designing and manufacturing full telecom chipsets however it would take affected person capital and time.

“Deep-tech merchandise take longer to mature, and India is simply now starting to assist that type of funding.”