Keep knowledgeable with free updates

Merely signal as much as the UK rates of interest myFT Digest — delivered on to your inbox.

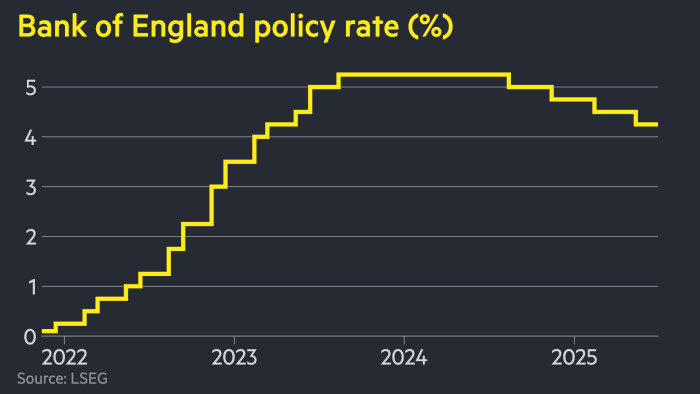

The Financial institution of England has held rates of interest at 4.25 per cent however signalled a doable lower as quickly as August after latest knowledge confirmed a weakening jobs market.

The six-to-three vote by the Financial Coverage Committee adopted a quarter-point lower in Might amid issues over the impression of US President Donald Trump’s aggressive tariff coverage.

“Rates of interest stay on a gradual downward path, though we’ve left them on maintain at present,” mentioned Andrew Bailey, the BoE’s governor.

Thursday’s broadly anticipated determination got here as policymakers wrestle with persistently robust inflation and the extra uncertainty posed by the escalating battle between Israel and Iran, and its potential impression on oil costs.

“The world is extremely unpredictable,” Bailey mentioned, including that the central financial institution would pay cautious consideration to the impression on inflation of the weak labour market.

Deputy governor Dave Ramsden joined exterior MPC members Swati Dhingra and Alan Taylor in calling for a right away additional lower in rates to 4 per cent.

Gordon Shannon, a fund supervisor at TwentyFour Asset Administration, mentioned the voting sample was “marginally extra dovish” than buyers had been anticipating.

The MPC predicted a “vital slowing” in pay development, an indication that one other price lower might be on the desk as quickly as its August 6 assembly, whereas additionally noting that “underlying UK GDP development seems to have remained weak”.

A report from the BoE’s community of regional brokers discovered enterprise hiring intentions to be “mildly detrimental” as corporations in sectors together with manufacturing, retail and development warned they weren’t anticipating a lot enchancment in buyer demand till 2026.

The MPC acknowledged that issues with the UK’s labour market knowledge continued to be a priority, however famous that Might’s 109,000 fall within the UK’s official estimate of payrolled staff was the biggest month-to-month contraction since Might 2020.

It added that an inner BoE measure advised a “subdued price of near-zero employment development”.

“Labour market developments recommend that the economic system is weakening quicker than anticipated,” mentioned Tomasz Wieladek, chief European economist for fastened revenue at asset supervisor T Rowe Worth.

The MPC’s concern over the weakening labour market got here as Hays, one of many UK’s largest recruitment corporations, warned on Thursday {that a} slowdown in hiring would hit its full-year earnings.

Shares within the group fell as a lot as 20 per cent earlier than recovering to commerce down 10 per cent.

Earlier this week, knowledge from the Workplace for Nationwide Statistics confirmed UK client worth inflation for May at 3.4 per cent, effectively above the BoE’s 2 per cent goal. The central financial institution expects CPI inflation to stay slightly below 3.5 per cent for the remainder of the 12 months, with a short rise to three.7 per cent in September.

The pound was flat in opposition to the greenback at $1.343 following the MPC’s determination.

Merchants saved their bets on additional price cuts largely unchanged, anticipating two quarter-point reductions by the top of the 12 months, based on ranges implied by swaps markets.

The BoE emphasised that coverage was not on a preset path, including that it was carefully watching “elevated” inflation expectations.

Because the worsening battle within the Center East dangers pushing oil costs greater, the MPC mentioned it might stay “delicate to heightened unpredictability within the financial and geopolitical atmosphere”, noting latest will increase in power prices.

The BoE reiterated its current steering that it might take a “gradual and cautious” method to future price reductions, which buyers have interpreted as pointing in the direction of quarterly cuts.

Extra reporting by Ian Smith