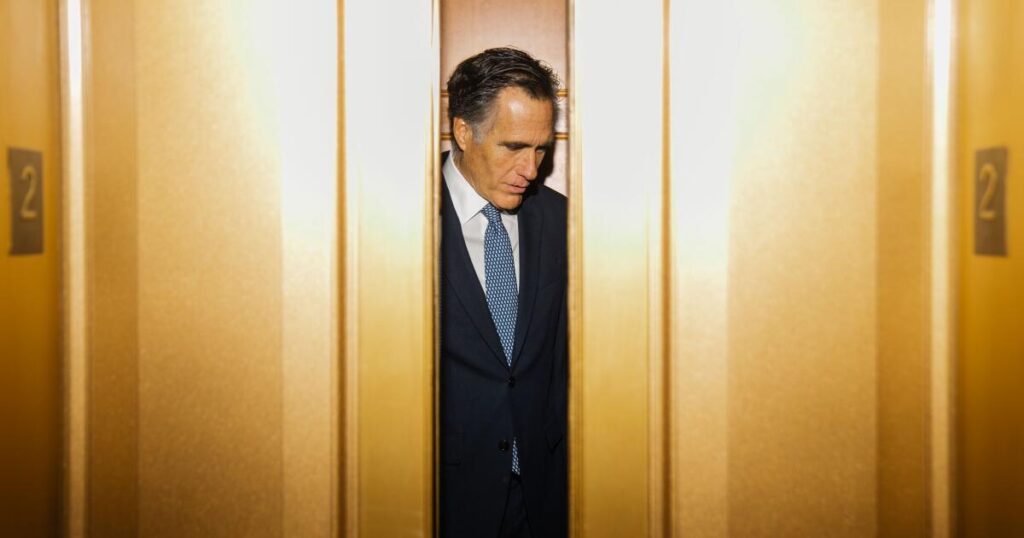

There’s something emotionally satisfying about watching a rich particular person name for larger taxes on individuals like himself. It feels civic-minded, even noble. A recent commentary by former Utah senator, Massachusetts governor and Republican presidential nominee Mitt Romney suits squarely into this custom. Confronted with a looming fiscal cliff, Romney concludes that entitlement reform is unavoidable and that larger taxes on prosperous People have to be a part of the answer.

Don’t be fooled, although. Sure, the established order is unsustainable and pretending in any other case is reckless. However taxing the wealthy can’t meaningfully remedy our underlying fiscal issues. Worse, pursuing that phantasm dangers making these issues tougher to repair whereas foreclosing alternatives for the following technology.

Begin with a primary arithmetic drawback that by no means goes away: Excessive-income households already shoulder a disproportionate share of the federal income-tax burden. The highest 1% pay roughly 40% of income-tax revenues; the highest 10% pay effectively over two-thirds. And when taxes and different transfers of wealth are factored in, the system has grow to be more and more progressive over time.

No matter one thinks about equity, this truth has enormous implications for gathering income. There’s merely not sufficient taxable revenue on the prime to finance a authorities constructed round massive, common, middle-class advantages.

Romney proposes elevating income by eradicating the cap on payroll taxes, taxing belongings extra closely at dying, ending like-kind exchanges in actual property, limiting state and native tax deductions and shutting the carried-interest desire. None of those concepts is new. Their income results have been studied repeatedly. Even underneath optimistic assumptions, their mixed yield over a decade quantities to solely a fraction of projected deficits. Trillions sound spectacular in isolation, however in opposition to tens of trillions in crimson ink, they’re a rounding error.

There’s a good deeper drawback with the “tax the wealthy” impulse. It assumes that these being taxed pays the complete price with out merely decreasing their tax publicity. Taxes change conduct. They alter funding selections, profession selections and the buildup of human capital. They nudge employers towards retirement slightly than towards one other spherical of hiring.

And better marginal tax charges on the prime don’t simply have an effect on at present’s rich individuals; they form the incentives of tomorrow’s entrepreneurs, engineers, docs and enterprise builders.

That is the place ethical posturing à la Romney turns into particularly troubling. It’s simple to say “tax me extra” when you’re already wealthy — with wealth already constructed, diversified and largely insulated. But when such a system had been imposed earlier, it would have reduced the chance that as many people would have grow to be rich within the first place.

In different phrases, the decision to tax the wealthy at present makes it tougher for younger individuals to grow to be wealthy tomorrow. Thanks lots.

That issues not as a result of everybody needs to be a billionaire, however as a result of financial mobility relies on the potential for outsized success. When the returns on extraordinary or distinctive effort, risk-taking and talent acquisition are diminished, fewer individuals put money into them. The proof is evident that extra progressive tax programs cut back incentives to build up human capital and increase companies over the long term. These prices present up slowly — in decrease productiveness, slower development and fewer alternatives. However they do present up.

We must also not assume that new tax income would really be used to scale back deficits. Particularly as a result of history suggests otherwise. When income rises, spending tends to rise with it, typically by greater than the rise in taxes. The promise that “this time is completely different” is commonplace, but it surely’s not often been saved.

The actual driver of at present’s fiscal imbalance stays largely untouched: spending on entitlement applications whose prices develop mechanically and whose advantages move more and more to people who find themselves already financially comfy. Romney is right that payouts needs to be means-tested for future retirees. However the notion that we will’t tweak the advantages of the retired or near-retired is nonsense. Many of them don’t rely upon Social Safety for his or her retirement revenue and obtain greater than they paid in.

If rich People genuinely imagine they need to contribute extra, they’re free to take action at present. The Treasury accepts voluntary funds. That’s a significantly better concept than utilizing their assets to help insurance policies that lock in a tax setting that stops youthful generations from constructing wealth within the first place.

The temptation to tax the wealthy is comprehensible. It feels truthful. It feels painless. It permits us to postpone tougher conversations. However emotions are usually not options. Such taxation won’t stabilize authorities funds and it’ll not restore confidence within the system. Worse, it dangers turning a society that when rewarded ambition into one which quietly penalizes it.

Veronique de Rugy is a senior analysis fellow on the Mercatus Heart at George Mason College. This text was produced in collaboration with Creators Syndicate.