In October, a small electronics producer within the western Indian state of Gujarat shipped its first batch of chip modules to a consumer in California.

Kaynes Semicon, along with Japanese and Malaysian expertise companions, assembled the chips in a brand new manufacturing unit funded with incentives below Indian Prime Minister Narendra Modi’s $10bn semiconductor push introduced in 2021.

Modi has been attempting to place India as a further manufacturing hub for international firms which may be trying to develop their manufacturing past China, with restricted success.

One signal of that’s India’s first business foundry for mature chips that’s at present below development, additionally in Gujarat. The $11bn mission is supported by expertise switch from a Taiwanese chipmaker and has onboarded the US chip large Intel as a possible buyer.

With firms the world over hungering for chips, India’s entry into that enterprise might increase its position in international provide chains. However specialists warning that India nonetheless has an extended technique to go in attracting extra overseas funding and catching up in cutting-edge expertise.

Unprecedented momentum

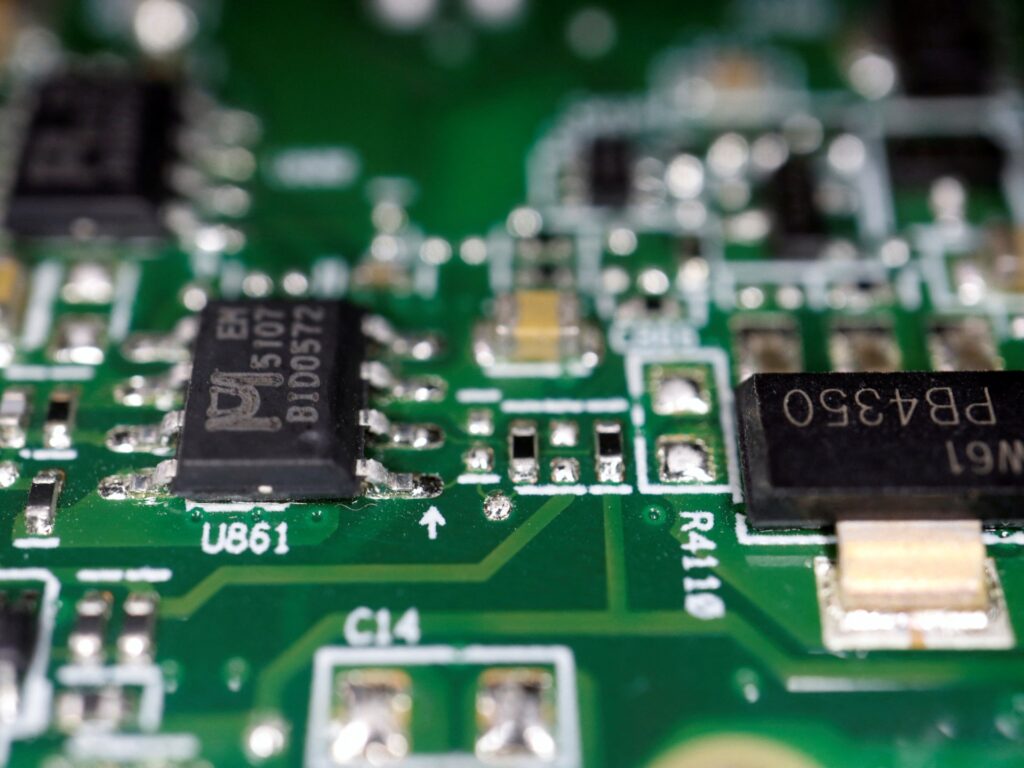

Semiconductor chips are designed, fabricated in foundries, after which assembled and packaged for business use. The US leads in chip design, Taiwan in fabrication, and China, more and more, in packaging.

The upcoming foundry in Gujarat is a collaboration between India’s Tata Group, one of many largest conglomerates within the nation, and Taiwan’s Powerchip Semiconductor Manufacturing Company (PSMC), which is aiding with the plant’s development and expertise switch.

On December 8, Tata Electronics additionally signed an settlement with Intel to discover the manufacturing and packaging of its merchandise in Tata’s upcoming services, together with the foundry. The partnership will deal with the rising home demand.

Final 12 months, Tata was authorised for a 50 % subsidy from the Modi authorities for the foundry, together with extra state-level incentives, and will come on-line as early as December 2026.

Even when delayed, the mission marks a pivotal second for India, which has seen a number of makes an attempt to construct a business fab stall prior to now.

The foundry will deal with fabricating chips starting from 28 nanometres (nm) to 110nm, sometimes known as mature chips as a result of they’re comparatively simpler to supply than smaller 7nm or 3nm chips.

Mature chips are utilized in most client and energy electronics, whereas the smaller chips are in excessive demand for AI information centres and high-performance computing. Globally, the expertise for mature chips is extra extensively out there and distributed. Taiwan leads manufacturing of those chips, with China quick catching up, although Taiwan’s TSMC dominates manufacturing for cutting-edge nodes beneath 7nm.

“India has lengthy been sturdy in chip design, however the problem has been changing that power into semiconductor manufacturing,” mentioned Stephen Ezell, vice chairman for international innovation coverage on the Washington, DC-based Info Know-how and Innovation Basis (ITIF).

“Prior to now two to a few years, there’s been extra progress on that entrance than within the earlier decade – pushed by stronger political will at each the central and state ranges, and a extra coordinated push from the personal sector to commit to those investments,” Ezell informed Al Jazeera.

Straightforward entry level

Greater than half of the Modi authorities’s $10bn in semiconductor incentives is earmarked for the Tata-PSMC enterprise, with the rest supporting 9 different initiatives targeted primarily on the meeting, testing and packaging (ATP) stage of the availability chain.

These are India’s first such initiatives – one by Idaho-based Micron Know-how, additionally in Gujarat, and one other by the Tata Group within the northeastern Assam state. Each will use in-house applied sciences and have drawn investments of $2.7bn and $3.3bn, respectively.

The remaining initiatives are smaller, with cumulative investments of about $2bn, and are backed by expertise companions similar to Taiwan’s Foxconn, Japan’s Renesas Electronics, and Thailand’s Stars Microelectronics.

“ATP items provide a decrease path of resistance in comparison with a big foundry, requiring smaller investments – sometimes between $50m and $1bn. Additionally they carry much less threat, and the mandatory expertise know-how is extensively out there globally,” Ashok Chandak, president of the India Electronics and Semiconductor Affiliation (IESA), informed Al Jazeera.

Nonetheless, many of the initiatives are delayed.

Micron’s facility, authorised for incentives in June 2023, was initially anticipated to start manufacturing by late 2024. Nonetheless, the corporate famous in its fiscal 2025 report that the Gujarat facility will “deal with demand within the latter half of this decade”.

Accredited in February 2024, the Tata facility was initially slated to be operational by mid-2025, however the timeline has now been pushed to April 2026.

When requested for causes behind the delays, each Micron and Tata declined to remark.

One exception is a smaller ATP unit by Kaynes Semicon, which in October exported a consignment of pattern chip modules to an anchor consumer in California – a primary for India.

One other mission by CG Semi, a part of India’s Murugappa Group, is in trial runs, with business manufacturing anticipated within the coming months.

The semiconductor initiatives below the Tata Group and the Murugappa Group have drawn public scrutiny after Indian on-line information outlet Scroll.in reported that each firms made huge political donations after they have been picked for the initiatives.

As per Scroll.in, the Tata Group donated 7.5 billion rupees ($91m) and 1.25 billion rupees ($15m), respectively, to Modi’s Bharatiya Janata Social gathering (BJP) simply weeks after securing authorities subsidies in February 2024 and forward of nationwide elections. Neither group had made such massive donations to the get together earlier than. Such donations aren’t prohibited by regulation. Each the Tata Group and the Murugappa Group declined to remark to Al Jazeera concerning the stories.

Assembly home demand a key precedence

The upcoming initiatives in India – each the foundry and the ATP items – will primarily deal with legacy, or mature, chips sized between 28nm and 110nm. Whereas these chips aren’t on the cutting-edge of semiconductor expertise, they account for the majority of worldwide demand, with functions throughout vehicles, industrial tools and client electronics.

China dominates the ATP section globally with a 30 % share and accounted for 42 % of semiconductor tools spending in 2024, based on DBS Group Analysis.

India has lengthy positioned itself as a “China Plus One” vacation spot amid international provide chain diversification, with some progress evident in Apple’s enlargement of its manufacturing base within the nation. The corporate assembles all its newest iPhone fashions in India, in partnership with Foxconn and Tata Electronics, and has emerged as a key provider to the US market this 12 months following tariff-related uncertainties over Chinese language shipments.

Its push within the ATP section, nevertheless, is pushed largely by the necessity to meet the rising home demand for chips, anticipated to surge from $50bn as we speak to $100bn by 2030.

“Globally, too, the market will develop from round $650bn to $1 trillion. So, we’re not shifting manufacturing from China to elsewhere. We’re capturing the incremental demand rising each in India and overseas,” Chandak mentioned.

India’s import of chips – each built-in circuits and microassemblies – has jumped in recent times, rising 36 % in 2024 to just about $24bn from the earlier 12 months. An built-in circuit (IC) is a chip serving logic, reminiscence or processing capabilities, whereas a microassembly is a broader package deal of a number of chips performing mixed capabilities.

The momentum has continued this 12 months, with imports up 20 % year-on-year, accounting for about 3 % of India’s whole import invoice, based on official commerce information. China stays the main provider with a 30 % share, adopted by Hong Kong (19 %), South Korea (11 %), Taiwan (10 %), and Singapore (10 %).

“Even when it’s a 28 nm chip, from a commerce steadiness perspective, India would somewhat produce and package deal it domestically than import it,” Ezell of ITIF mentioned, including that home functionality would improve the competitiveness of chip-dependent industries.

Higher incentives wanted

The Modi authorities’s help for the chip sector, whereas unprecedented for India, continues to be dwarfed by the $48bn dedicated by China and the $53bn provisioned below the US’s CHIPS Act.

To attain scale within the ATP section for significant import substitution – and to advance in direction of producing chips smaller than 28nm – India will want continued authorities help, and there’s a second spherical of incentives already within the works.

“The truth is, if India needs to compete at the forefront of semiconductors, it might want to appeal to a overseas associate – American or Asian – since solely a handful of firms globally function at that stage. It’s extremely unlikely {that a} home agency shall be aggressive at 7nm or 3nm anytime quickly,” Ezell mentioned.

In accordance with him, India must proceed specializing in enhancing its general enterprise atmosphere – from making certain dependable energy and infrastructure to streamlining rules, customs and tariff insurance policies.

India’s engineers make up a couple of fifth of the worldwide chip design workforce, however rising competitors from China and Malaysia to draw multinational design companies might erode that edge.

In its newest incentive spherical, the Indian authorities restricted advantages to home companies to advertise native mental property – a transfer that, based on Alpa Sood, authorized director on the India operations of California-based Marvell Know-how, dangers driving multinational design work elsewhere.

“India already has a thriving chip design ecosystem strengthened by early-stage incentives from the federal government. What we’d like, to additional speed up and construct stronger R&D muscle – is incentives that mirror competing nations like China [220 percent tax incentives] and Malaysia [200 percent tax incentives]. This can guarantee we don’t lose the benefit we’ve constructed over time,” Sood informed Al Jazeera.

Marvell’s India operations are its largest outdoors the US.

The Trump impact

India’s upcoming chip services, whereas geared toward assembly home demand, can even export to purchasers within the US, Japan, and Taiwan. Although US President Donald Trump has threatened one hundred pc tariffs on semiconductors made outdoors the US, none have but been imposed.

An even bigger concern for India-US engagement – thus far restricted to training and coaching – is Washington’s 50 % tariff on India over its Russian crude imports. Semiconductors stay exempt, however the broader commerce local weather has turned unsure.

“Over half the worldwide semiconductor market is managed by US-headquartered companies, making engagement with them essential,” Chandak mentioned. “Any alignment with these companies, both by means of joint ventures or expertise partnerships – is a most well-liked choice.”

The worldwide chip race is accelerating, and India’s insurance policies might want to hold tempo to grow to be a severe participant amid rising geo-economic fragmentation.

“These new 1.7nm fabs are so superior they even issue within the moon’s gravitational pull – it’s actually a moonshot,” Ezell mentioned. “Semiconductor manufacturing is essentially the most advanced engineering activity humanity undertakes – and the policymaking behind it should be simply as exact.”