Suranjana TewariAsia Enterprise Correspondent

Reuters

ReutersIn late September, the Dutch authorities invoked a Chilly Battle-era emergency legislation to take management of a Chinese language-owned chip firm that has operations within the nation.

The extraordinary transfer set off a series of occasions that despatched shock waves via the worldwide motor business – already battered by US tariffs and China’s curbs on uncommon earth exports.

In an announcement to the Netherlands parliament, the minister of financial affairs cited “critical governance shortcomings and actions inside Nexperia” that “posed a risk”.

“This measure is extremely distinctive and supposed solely to make sure that the continuity of provide and safeguarding of vital applied sciences for the Dutch and European financial system usually are not put in danger,” the assertion mentioned.

Beijing reacted furiously, accusing the Netherlands of political interference.

It imposed export controls and halted deliveries of Nexperia chips from its Chinese language amenities to Europe, whereas the Dutch authorities froze shipments of key provides wanted to make the chips in China.

The disruption brought about to the motor business highlighted a serious weak point within the world provide chain of chips very important to automotive manufacturing and opened one more entrance within the rivalry between the US and China.

The Chinese government has now granted exemptions to export controls on the chips for civilian purposes however has not clarified what it considers these to be.

However Chinese language authorities nonetheless need the Dutch to revoke the takeover of Nexperia.

“China welcomes the EU to proceed exerting its affect to induce the Netherlands to appropriate its faulty practices as quickly as attainable,” the commerce ministry mentioned in an announcement on Sunday.

Nexperia’s guardian firm Wingtech Expertise didn’t reply to a BBC request for remark.

Weaponising provide chains

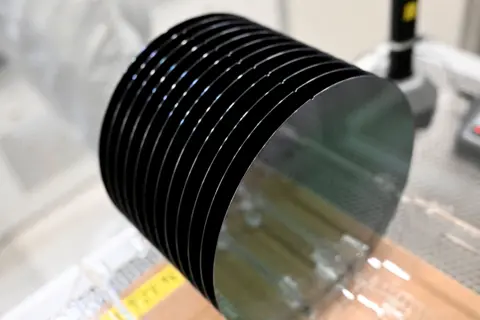

On the centre of the dispute is a vital a part of the world’s chip ecosystem.

Nexperia makes so referred to as “legacy” or “constructing block” semiconductors which are very important for every thing from power-steering and airbags to central locking methods. These usually are not cutting-edge chips, however they’re nonetheless indispensable.

Some automobiles comprise a whole bunch of them, and Nexperia provides chips to main carmakers world wide.

Round 70%-80% of its output is shipped to China for processing, testing and packaging – a dependence that has left automotive makers uncovered to Beijing’s management over provide chains.

“Automotive markers blindsided by the Nexperia mess ought to be hiring new provide chain administration executives, as they clearly realized nothing from Covid… and extreme reliance on [Chinese] provide chains,” China watcher Invoice Bishop wrote in his Sinocism e-newsletter.

It underscores China’s means to choke off world provide chains – simply because it did with uncommon earth exports.

Just like vital minerals, China can maintain the West hostage with management of an organization as inconspicuously essential as Nexperia, based on Invoice Echikson, Senior Fellow for the Tech Coverage Program at Heart for European Coverage Evaluation. That is as a lot about digital sovereignty as it’s about semiconductors, he provides.

Beijing faces a dilemma although. It has been pitching itself as a dependable companion within the face of Trump’s tariff chaos, however reducing off provides of vital merchandise dangers undermining that message.

“The narrative was [that, since] Trump got here in and brought about chaos for everyone, perhaps there’s a chance for China and the EU to work extra carefully collectively,” mentioned Tom Nunlist, Affiliate Director at Trivium China.

That did not go so nicely, he provides, with the uncommon earths scarcity displaying how trapped Europe and different buying and selling companions are between the US and China, and their means to upend world commerce, based on Mr Nunlist.

Nationwide safety

Together with the takeover, a Dutch courtroom additionally suspended Nexperia’s former chief government Zhang Xuezhen – who based its Chinese language proprietor Wingtech – citing mismanagement.

Wingtech’s shares commerce on the Shanghai Inventory Alternate and it’s partially owned by the Chinese language authorities.

It was positioned on an official US watch listing in 2024, and the so-called entity listing was expanded this September to incorporate any agency that’s at the least 50% owned by corporations already on the listing.

Based on courtroom papers launched by the Dutch authorities final month in relation to the federal government’s takeover of Nexperia, US authorities had raised issues in regards to the boss of the chip firm earlier than it was taken over.

The paperwork contained proof that Dutch authorities had informed Nexperia it might be able to safe an exemption from the US listing if there was a change in management as a result of the “Chinese language proprietor is problematic”.

“It’s nearly sure that the CEO should get replaced to qualify for the exemption from the entity listing,” authorities informed Nexperia, based on the paperwork.

Reuters

ReutersThe Hague denies the takeover of Nexperia was a response to stress from any international nation however mentioned there was proof to recommend the corporate’s chief government was transferring its manufacturing capability, monetary assets and mental property to China.

Wingtech didn’t reply to a request for touch upon this.

“I believe Nexperia simply underlines what’s already true, and makes it more true,” mentioned Mr Nunlist from Trivium China.

“Western international locations don’t desire Chinese language buyers in a lot of these strategic manufacturing property, even legacy chips.”

Automotive makers on edge

Consultants say the incident is an instance of the very actual influence of undoing enterprise and financial ties between the West and China.

“That is what decoupling really seems like on the company degree, and it is an enormous mess,” mentioned Mr Nunlist.

European automobile business suppliers have sought readability on the exemptions that can be utilized, and have mentioned it creates further paperwork at an already unsure time.

Getty Pictures

Getty PicturesIt’s attainable to modify suppliers, say consultants, as rivals chip makers like Infineon, NXP and Texas make comparable chips.

However provide chains usually are not exactly deliberate, they evolve organically and these elements are sometimes tailor made for autos, Mr Nunlist of Trivium China mentioned.

“Firms cannot transfer on a dime; there are incentives to maintain provide chains in place and it is extraordinarily sophisticated and expensive to vary issues.”

Fragile truce

The incident comes as US President Donald Trump and China’s President Xi Jinping agreed to a one-year commerce truce – a deal which suspended some export bans and uncommon earth restrictions.

However the Nexperia dispute means that this newly-minted settlement could also be a fragile one.

The US isn’t going to explode the deal although, based on Mr Nunlist, and Europe would not have a lot leverage particularly on this sport of provide chain weaponisation.

“That is actually politically difficult for either side, and for Europe as a result of it would not need this to finish with chip capability leaving Europe,” Mr Nunlist mentioned.

“My understanding is that leaders in Brussels have been unaware that the Dutch authorities was planning to make this transfer and have been sad with it.”

China and the EU stay locked in pressing negotiations to raise export controls on each chips and uncommon earths.

Talks are persevering with with China on discovering a “lasting, steady, predictable framework that guarantee the complete restoration of semiconductor flows”, EU commerce commissioner Maros Sefcovic mentioned in a put up on X over the weekend.

However the episode has uncovered vulnerabilities in key provide chains – and ties between China and the Netherlands, and in flip the European Union, are more likely to stay underneath stress till the discord over Nexperia’s possession and operations is absolutely resolved.