The author is professor of economics at Harvard College and writer of ‘Our Greenback, Your Drawback’

US fiscal coverage is working off the rails, and there appears to be little political will in both get together to repair it till a significant disaster happens.

The 2024 finances deficit was a mind-blowing 6.4 per cent of GDP; credible forecasts recommend that the deficit will exceed 7 per cent of GDP for the remainder of President Donald Trump’s time period. And that’s assuming there is no such thing as a black swan occasion that after once more causes progress to crater and debt to balloon. With US debt already exceeding 120 per cent of GDP, it appears a finances disaster of some kind is extra seemingly than not over the following 5 years.

True, if markets trusted US politicians to prioritise totally repaying bond holders — home and overseas — above all else, and to not interact in partial default by way of inflation, there can be nothing to fret about.

Sadly, if one seems to be on the lengthy historical past of debt and inflation crises, the overwhelming majority happen in conditions the place the federal government may pay if it felt prefer it. Sometimes, a disaster is catalysed by a significant shock that catches policymakers on their again foot, when debt is already very excessive, and financial coverage rigid.

Actually the One Massive Lovely Invoice Act preserves the tax cuts from Trump’s first time period, which in all chance helped spur progress. Nevertheless, the proof from a number of rounds of tax cuts going again to Ronald Reagan within the Nineteen Eighties means that they don’t practically pay for themselves. Certainly they’ve been the foremost contributor to the regular run-up in debt through the twenty first century. And Trump’s new tax invoice incorporates a raft of extremely distortionary add-ons — no tax on ideas, time beyond regulation or social safety — that aren’t useful. Not surprisingly, the Congressional Funds Workplace concluded that the invoice would add $2.4tn to debt over the following decade.

The true drawback for politicians is that American voters have grow to be conditioned to by no means having to take care of sacrifice. And why ought to they?

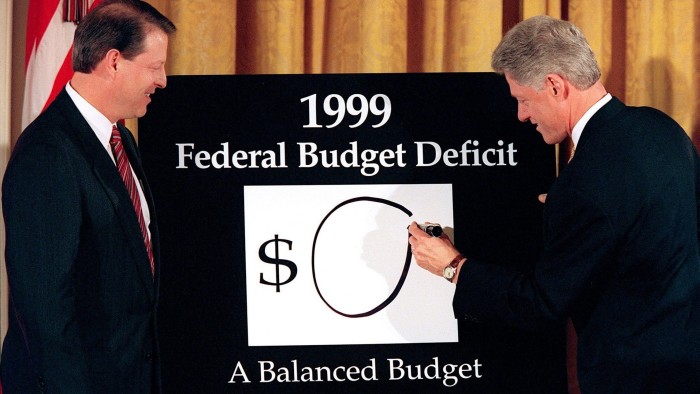

Since Invoice Clinton final balanced the finances on the finish of the Nineteen Nineties, each Republican and Democratic leaders have tripped over themselves to run ever bigger deficits, seemingly with out consequence. And if there’s a recession, monetary disaster or pandemic, voters rely on getting the very best restoration that cash should purchase. Who cares about one other 20 to 30 per cent of GDP in debt?

What has modified, sadly, is that long-term actual rates of interest in the present day are far greater than they had been within the 2010s. Between 2012 and 2021, the inflation-indexed 10-year US Treasury bond yield averaged round zero. Right now, it’s over 2 per cent and, going ahead, curiosity funds are more likely to be an ever-larger pressure pushing up the US debt-to-GDP ratio. Actual curiosity rises are much more painful in the present day than they had been twenty years in the past, when US debt to GDP was half what it’s now.

Why are actual charges rising? One cause, after all, is document international debt ranges, each private and non-private. That is solely a part of the story, nonetheless, and never essentially crucial half.

Different components — together with geopolitical tensions, the fracturing of worldwide commerce, rising navy expenditures, the possible energy wants of AI and populism — are all necessary. Sure, inequality and demographics arguably push the opposite means, which is why a lot of distinguished students nonetheless consider a sustained return to ultra-low actual rates of interest will finally save the day. However ought to the US, which goals to be international hegemon for an additional century or extra, be betting the farm on this?

Certainly, though long-term rates of interest might fall, it’s equally attainable they could rise with the US 10-year charge, now round 4.5 per cent, ultimately reaching 6 per cent or extra. The rise will probably be exacerbated if Trump succeeds in reaching his dream of a decrease US present account deficit, the flip facet being much less overseas cash coming into the US.

It can even be exacerbated if, as I argue in my latest book, US greenback dominance is now fraying on the edges as China continues decoupling from the greenback, Europe remilitarises and cryptocurrencies take market share within the large international underground economic system.

Trump’s tariff wars, threats to tax overseas funding and efforts to undermine the rule of regulation will solely speed up the method. Certainly, if he succeeds in reaching his dream of closing up the US present account deficit, the diminished influx of overseas capital will push US rates of interest up additional, and progress can even undergo.

Simply because the US debt trajectory is unsustainable doesn’t imply it wants to finish dramatically. In spite of everything, as an alternative of permitting rates of interest to proceed drifting up, the federal government can invoke growth-stifling Japanese-style monetary repression, maintaining rates of interest artificially low and thereby changing any disaster right into a slow-motion crash.

However sluggish progress is hardly a fascinating final result, both. Inflation is the extra seemingly state of affairs given the centrality of finance to US progress, with the federal government (whether or not Trump or a successor) discovering a method to undermine the independence of the Federal Reserve. The US’s excessive debt and rigid political equilibrium will probably be a significant amplifier of the following disaster and, in most eventualities, the American economic system and the greenback’s international standing would be the losers.