Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Eurozone inflation remained at 2.2 per cent in April, surpassing expectations and complicating the European Central Financial institution’s job because it considers whether or not to chop rates of interest additional at its subsequent assembly in June.

Economists had predicted that the determine would fall to 2.1 per cent, based on a ballot by Reuters.

“The ECB will in all probability look by this shock,” stated Tomasz

Wieladek, economist at T Rowe Value, emphasising that the central financial institution was rising its concentrate on financial exercise within the Eurozone, which latest surveys have indicated is weak.

“A lot decrease oil costs and a stronger euro nonetheless have but to totally feed by to inflation,” he added.

The euro was flat after the information, as buyers continued to guess on fee cuts. It was up 0.4 per cent in opposition to the greenback by late afternoon in London at $1.134.

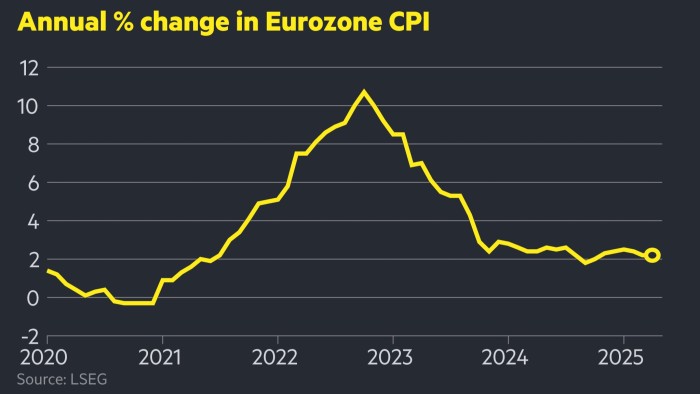

Friday’s determine marks the sixth month in a row that inflation within the single foreign money bloc has been above the ECB’s goal of two per cent.

Annual core inflation, which excludes extremely risky costs for power and meals, rose to 2.7 per cent, surpassing each the earlier month’s tempo of two.4 per cent and economists’ expectations of a 2.5 per cent fee.

Companies inflation — a intently watched metric that the ECB regards as an vital gauge of home value strain — elevated to three.9 per cent yr over yr, after falling to three.5 per cent in March.

Analysts at Capital Economics stated the providers inflation rise was “unlikely to fret ECB officers an excessive amount of because it was in all probability pushed primarily by Easter timing results” and was “unlikely to face in the best way” of additional cuts.

Economists argue that the year-on-year comparability is distorted by the truth that the Easter holidays — a time when providers in motels, eating places and

different areas are likely to rise due to an increase in journey — have been in April this

yr however in March final yr.

Merchants put a roughly 90 per cent likelihood on a quarter-point reduce on the ECB’s June assembly, based on ranges implied by swaps markets, largely unchanged from earlier than the discharge. Total, two or three such cuts are anticipated by the tip of the yr.

The ECB started decreasing charges final summer season after battling to tame an unprecedented surge in shopper costs throughout the coronavirus pandemic, when inflation peaked at 10.6 per cent.

ECB rate-setters voted unanimously final month to chop charges by 1 / 4 level to 2.25 per cent, citing issues over progress amid “rising commerce tensions” from US President Donald Trump’s aggressive tariff agenda.

Christine Lagarde, ECB president, added final month that “most measures of underlying inflation” instructed that the central financial institution was on monitor to fulfill its goal “on a sustained foundation”.

Whereas the Eurozone financial system carried out higher than anticipated within the first three months of the yr, with progress of 0.4 per cent, the announcement of Trump’s so-called “reciprocal duties” has since dented the outlook for the area.

“The ECB has indicated it’s not as involved about inflation as it’s on progress because of the tariff affect,” stated Francesco Pesole, FX strategist at ING. In different circumstances, buyers would count on a hawkish shift from the central financial institution, he added.