Asian shares plunged once more throughout Wednesday’s buying and selling session after President Donald Trump’s newest batch of sanctions on China got here into pressure, serving to wipe off Tuesday’s restricted positive aspects and compounding a turbulent week for the world’s key indexes.

Trump’s new measures elevated the cumulative price of tariffs on Chinese goods to 104% — a transfer met with extra condemnation in Beijing, the place officers warned that China is able to combat an prolonged commerce warfare if compelled to take action.

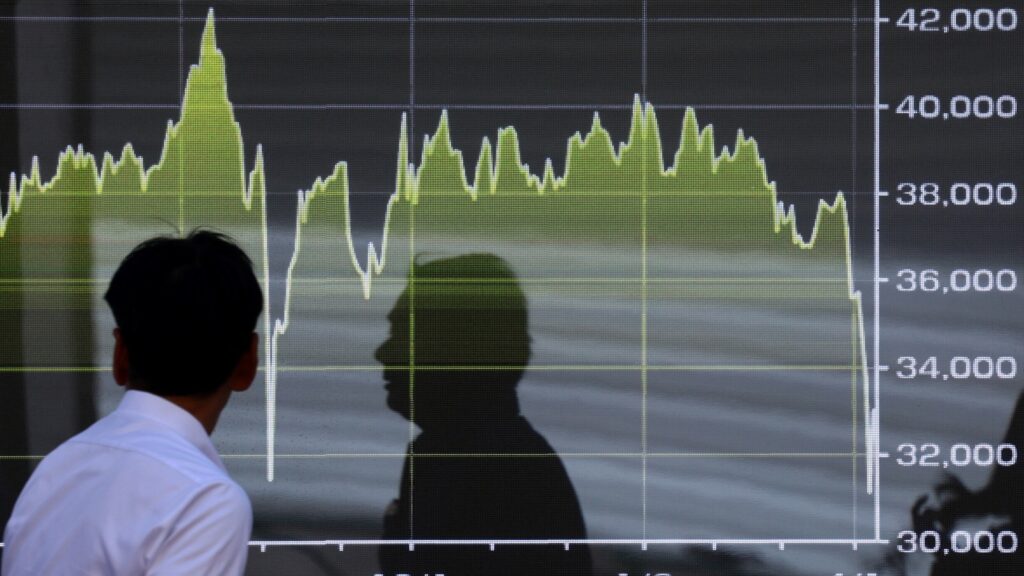

The newest tariffs got here into pressure with key Asian markets already open. In Japan, the Nikkei index dropped greater than 5% in response, whereas the broader TOPIX index slipped 4.6%.

In China, Hong Kong’s Dangle Sen index slipped 4.3%. The Shanghai Composite Index — which has fewer worldwide traders and is buoyed by the state-owned traders generally known as the “Nationwide Group” — posted positive aspects of round 1%.

Transport containers are seen on the Port Jersey Container Terminal, with the Manhattan skyline within the distance, in Jersey Metropolis, New Jersey, April 8, 2025.

Charly Triballeau/AFP by way of Getty Pictures

Shares in Taiwan fell greater than 5.7%, Singapore’s STI index slipped 2.4%, South Korea’s KOSPI index misplaced round 1.9%, Australia’s S&P/ASX 200 misplaced 1% and India’s NIFTY 50 dropped 0.6%.

U.S. inventory market futures indicated continued uncertainty, regardless of the White Home touting possible deals with as many as 70 nations searching for to keep away from the impression of Trump’s tariff marketing campaign.

Dow Jones futures had been down 2.4% as of Wednesday morning, with S&P 500 futures down 2.7% and Nasdaq futures down 2.6%.

United States shares closed decrease on Tuesday, marking a significant reversal from a rally that despatched the S&P 500 and Nasdaq up greater than 4% earlier within the day.

The Dow Jones Industrial Common closed down 320 factors, or 0.8%, whereas the Nasdaq dropped 2.1%.

The S&P 500 fell 1.5%, placing the index on the point of a bear market, a time period that signifies a 20% drop from a earlier peak.

The transfer decrease on Tuesday resumed a selloff that stretches again to Trump’s tariff announcement final week. Since then, the S&P 500 and Nasdaq have every fallen greater than 12%.

A passerby is mirrored on an digital display displaying a graph exhibiting latest Japan’s Nikkei share common actions outdoors a brokerage in Tokyo, Japan, on April 9, 2025.

Issei Kato/Reuters

ABC Information’ Max Zahn contributed to this report.