Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

The author is Norway’s minister of finance

Governments worldwide are fascinated by the right way to finest design tax methods to make sure that their economies can keep aggressive and grow to be environmentally sustainable, whereas persevering with to boost adequate revenues.

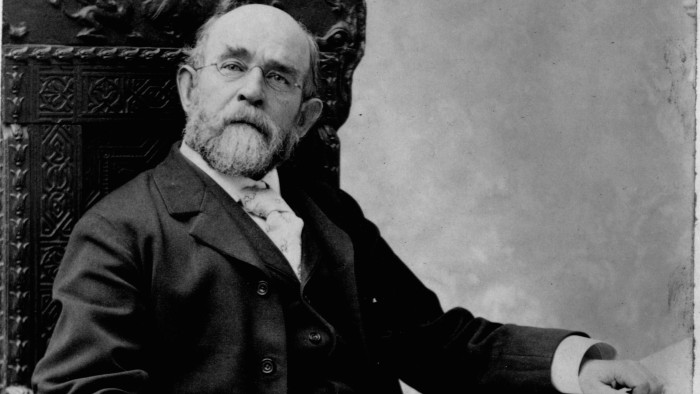

On this context, it’s value revisiting the concepts of Henry George, the Nineteenth-century American political economist. His views on how financial progress can result in extraordinary revenues for some in society, because of their privileged entry to land or different widespread sources, throw invaluable mild on right now’s tax debate.

Within the late Nineteenth century, when the railways had been increasing westward within the US, George pointed to the extraordinary enhance within the worth of land ensuing from the place the tracks had been being laid. He argued that this could profit everybody, not simply those that occurred to personal the land.

As a politician, George campaigned for the substitute of all different taxes with a single tax on land hire. Sadly, we are going to by no means know what would have occurred had he succeeded: whereas campaigning to be the mayor of New York in 1897 he died from a stroke. However his concepts travelled throughout the Atlantic to Europe.

Ever since Norway turned an unbiased nation in the beginning of the twentieth century, the political consensus has been that “tremendous” earnings from harnessing pure sources ought to profit the entire nation. This precept was first utilized to the regulation of hydropower manufacturing. Later, when oil was found within the North Sea, Norwegian power coverage sought to make sure that a considerable portion of the earnings from petroleum manufacturing would accrue to society in its entirety. Lately, the federal government has taken this precept additional, introducing useful resource hire tax on aquaculture and onshore wind energy.

George’s considering additionally provides an attention-grabbing place to begin when contemplating the right way to tax super-profits globally. In his railway evaluation, the problem was the right way to pretty redistribute the worth of particular chunks of land. Within the international financial system however, super-profits can come up when enterprises aren’t positioned in a single place.

Such corporations usually make use of complete person information from social media or different digital platforms, or intangible property resembling worldwide patents. In addition they profit from specialised international worth chains. The outcomes are vital synergies, appreciable market energy and earnings on a hitherto unimaginable scale.

In a globalised and digitised world, we might want to transcend George’s concepts. If extremely worthwhile worldwide enterprises that function throughout borders are to pay taxes the place the revenues are generated, worldwide tax co-operation is vital. At the moment, a number of commendable multilateral initiatives are beneath option to clear up these challenges.

It’s also clear that George’s single tax or different conventional approaches won’t clear up right now’s problem of taxing super-profits generated by massive multinational corporations with cell property working in know-how or prescription drugs. Nonetheless, I consider most individuals would agree that a few of these super-profits ought to profit the states that supply the required infrastructure to permit these enterprises to create worth within the first place.

The one option to obtain that is by worldwide tax co-operation. The OECD and G20 Inclusive Framework on Base Erosion and Revenue Shifting has already laid the foundations for fairer and extra environment friendly taxation of multinationals. A world minimal tax of 15 per cent is applied in additional than 50 jurisdictions and counting. “Pillar one” of the framework has the potential to deal with most of the challenges we face in taxing these corporations.

Had been he alive right now, George would remind us that governments ought to be sure that super-profits profit their residents. Worldwide tax co-operation is the way in which to do that.